A Perfect Storm for Maritime Sustainability

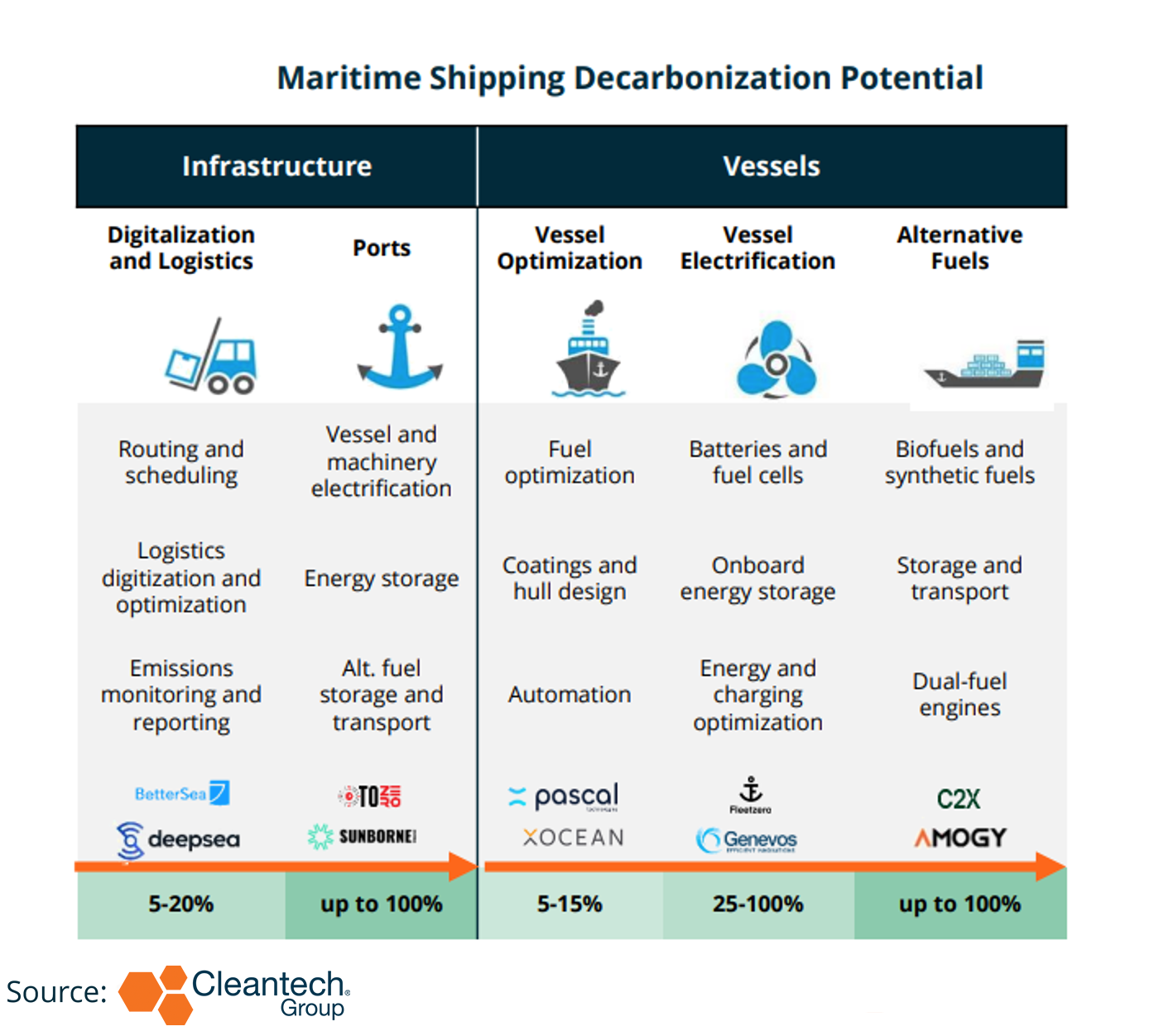

Maritime sustainability is a broad sector, encompassing digitalization and optimization of logistics, vessel optimization and electrification, alternative low- and-zero-carbon fuels, as well as port decarbonization and infrastructure for renewable energy generation and storage and alternative fuels production, transport, and storage. The maritime industry is a key sector to meet global decarbonization targets — maritime transport accounts for 80% of global trade and 3-5% of global emissions.

The maritime sector is considered a hard to abate industry due to its asset-heavy and fragmented nature, coordination between local, national, and international actors, high dependence on infrastructure and regulation, and reputation as being slow to adapt and innovate. Despite this innovation-averse reputation, the maritime industry is currently experiencing unprecedented momentum for sustainability and decarbonization.

Regulation and Sustainability Targets Driving Demand for Sustainable Maritime Solutions

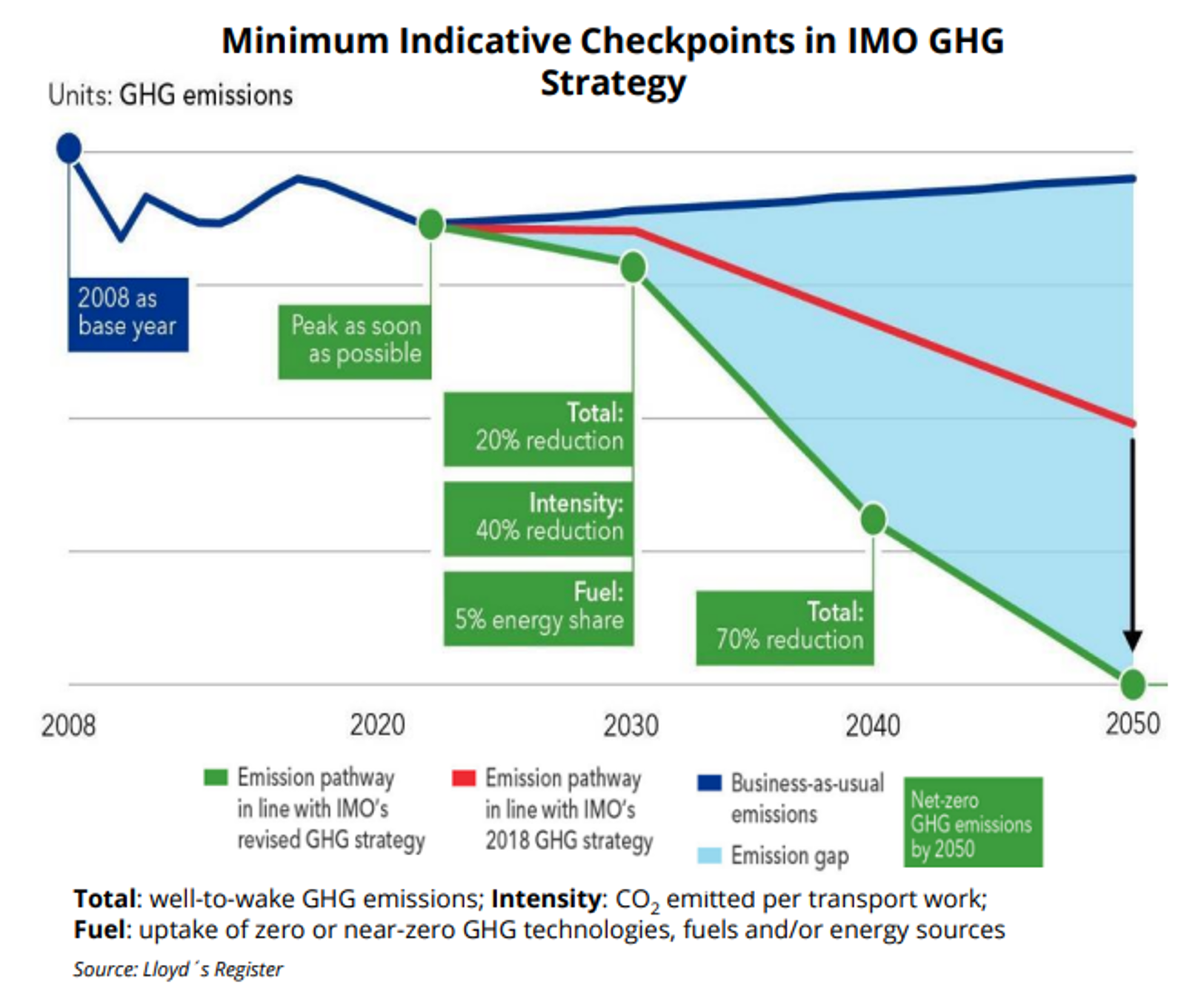

There are several key factors that contribute to the boom in demand for sustainable maritime technologies. Notably, the International Maritime Organization (IMO) recently announced ambitious new decarbonization targets: 20% decarbonization by 2030, 70% by 2040, and 100% by 2050. To meet these goals, shipping companies, port operators, and other maritime actors must begin to cut emissions immediately.

New and incoming regulations enforcing the IMO targets place additional pressure on maritime actors to comply (e.g., EU Emissions Trading System, FuelEU Maritime, California At-Berth Regulation). Where regulations have not been put in place, corporate sustainability goals, in particular emphasis on Scope 2 and Scope 3 emissions, place pressure on global shipping companies and fleet operators to cut emissions and adopt sustainable practices and technologies.

Innovators Providing Emissions-cutting and Cost-saving Solutions

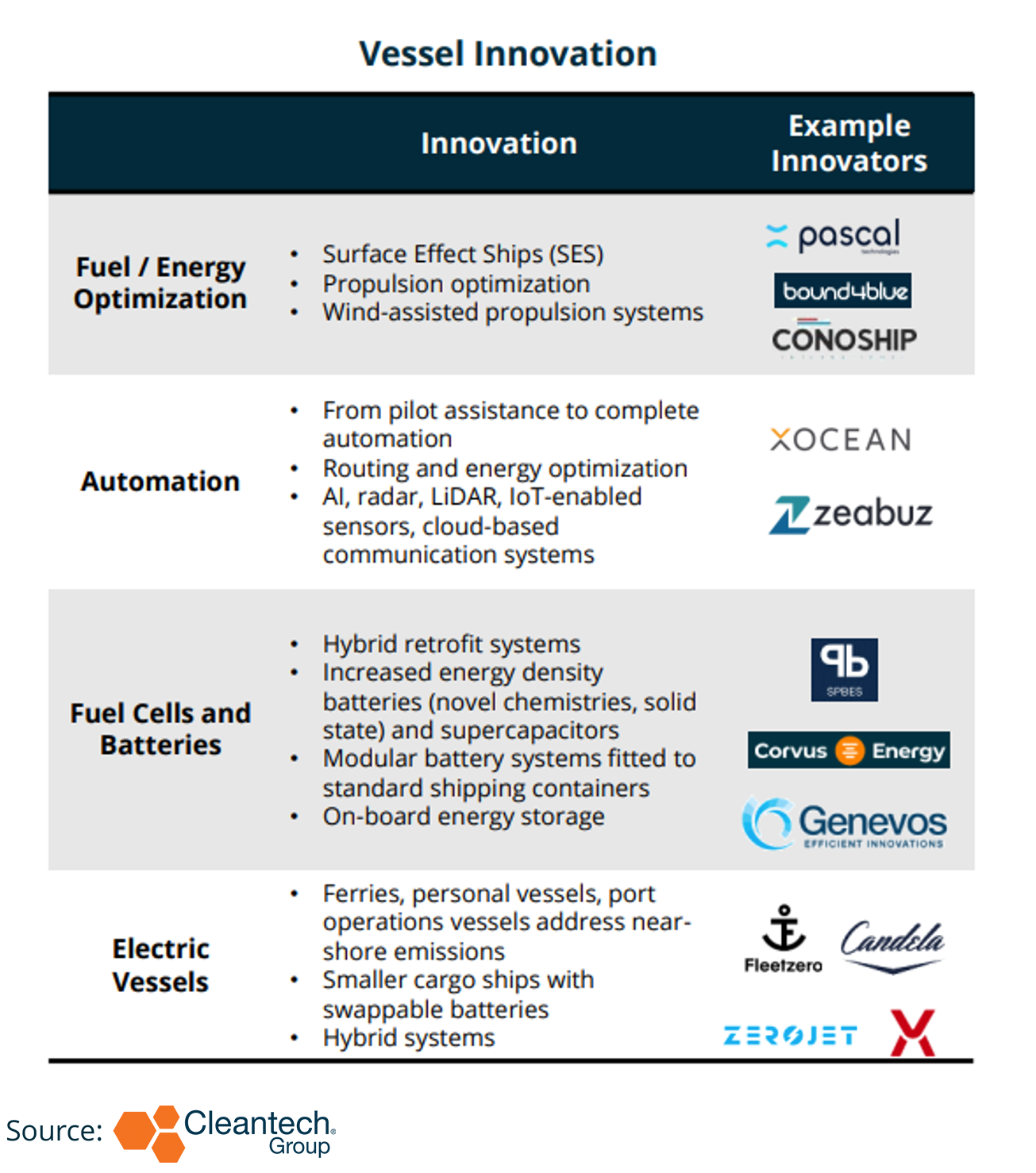

A wide range of technology innovations provide demand owners (shipping companies, fleet operators, ports and logistics management) with solutions to incrementally reduce emissions. Vessel design optimization (e.g., Pascal Technologies), wind propulsion (e.g., Bound4Blue), automation solutions (e.g., Zeabuz), and logistics and routing (e.g., BetterSea) optimization software can achieve roughly 5-25% fuel savings and emissions reductions. Advancements in data analytics, AI and machine learning modelling, and continued digitalization of operations and logistics provide shipping companies and fleets with the tools to accurately monitor and report emissions.

Infrastructure and Technology Roadblocks Stand in the Way of Deep Decarbonization

While interim decarbonization goals may be met by these optimization technologies and efficiency solutions, meeting the longer-term goals of 70%-100% decarbonization will only be achieved through systems-level transition to zero-carbon fuels and vessel and port electrification. Critical challenges stand in the way of this industry-wide transition. On the technology side, efficiency improvements and up-front cost reduction of key technologies such as batteries, hydrogen fuel cells, and electrolysers will be essential to increase the market uptake of battery- and hydrogen-electric vessels and vehicles.

Ditching Bunker Fuels — The Future of Zero-carbon Fuels

However, the key to the maritime decarbonization puzzle will clearly be alternative fuels. The current industry-standard solution, Liquefied Natural Gas (LNG) only offers up to 25% CO2 reductions. While LNG may be an interim solution to reduce emissions, zero-carbon fuels are needed to meet 2040 and 2050 decarbonization targets — the main contenders being e-ammonia, e-methanol, and green hydrogen.

These synthetic fuels provide full decarbonization and zero carbon emissions when produced with renewable energy, though significant challenges stand in the way of widespread market uptake:

- Prohibitively high production costs (due to high cost of green hydrogen production, electricity costs, additional production technologies such as Direct Air Capture (DAC)

- Technologically challenging and costly transport and storage (cryogenic and/or high-pressure storage)

- Low energy density requiring significant storage space

- Toxicity, corrosiveness, and handling and storage safety concerns

- Vessel compatibility—dual-fuel engines, propulsion system and storage space retrofits required

Currently, there is no consensus on future fuel mix scenarios or which fuel will be most widely adopted. The key variables to which fuel will take a dominant share of the future fuel market will be availability and production, cost, and solutions to technical challenges such as transport and storage.

Innovators such as Amogy (ammonia cracking), BeHydro (dual-fuel engines), Hexagon Purus (hydrogen storage), and C2X (e-methanol production) are developing solutions to some of these challenges.

Keep an eye out for…

- Further regulation to incentivize and enforce decarbonization will continue to move the needle on emissions reductions and the adoption of decarbonization technologies

- Global shipping Corporates are actively engaging in alternative fuels — these first movers have significant market influence by both investing in fuel production value chains and transitioning their fleets. Risk as a first mover is high, and shipping Corporates will prioritize future-proofing fleets when considering transitioning fleets to a future fuel

- Subsidies for green hydrogen production and renewable energy as well as carbon taxes will be essential tools to balance the increased cost of alternative fuels compared to conventional bunker fuel