- Home

- ::

- The Cleantech Group Taxonomy

The Cleantech Group Taxonomy

Cleantech Group’s proprietary taxonomy reflects our up-to-date view on companies that are cleantech and innovative, applying the original and trademarked definition of the cleantech term (from 2003) to the market of today.

The Cleantech Group taxonomy includes innovative technologies that have the potential to:

Provide superior performance or decrease costs

Greatly reduce or eliminate negative ecological impact or enhance resilience to the effects of changing climate

Or Improve the productive use of regenerative resources or avoid the use of polluting resources

The Cleantech Group taxonomy includes companies that are innovating technologies that are materially different from incumbent solutions.

The taxonomy excludes those companies, that while being important users of innovative technologies, are not innovators of those technologies themselves:

- Project developers

- Marketplaces

- Asset owner / operators

- Contract manufacturing

- Service providers (engineering, procurement, operations, and maintenance providers)

Reflecting our Real-time View of the World

Each company is tagged with specific technology types, to allow users to make granular comparisons and contrasts – there are over 1,400 unique tags in use.

The goal of the Cleantech Group taxonomy is to provide users the ability to build a bottom-up perspective on cleantech innovation’s trajectory and impact on the market.

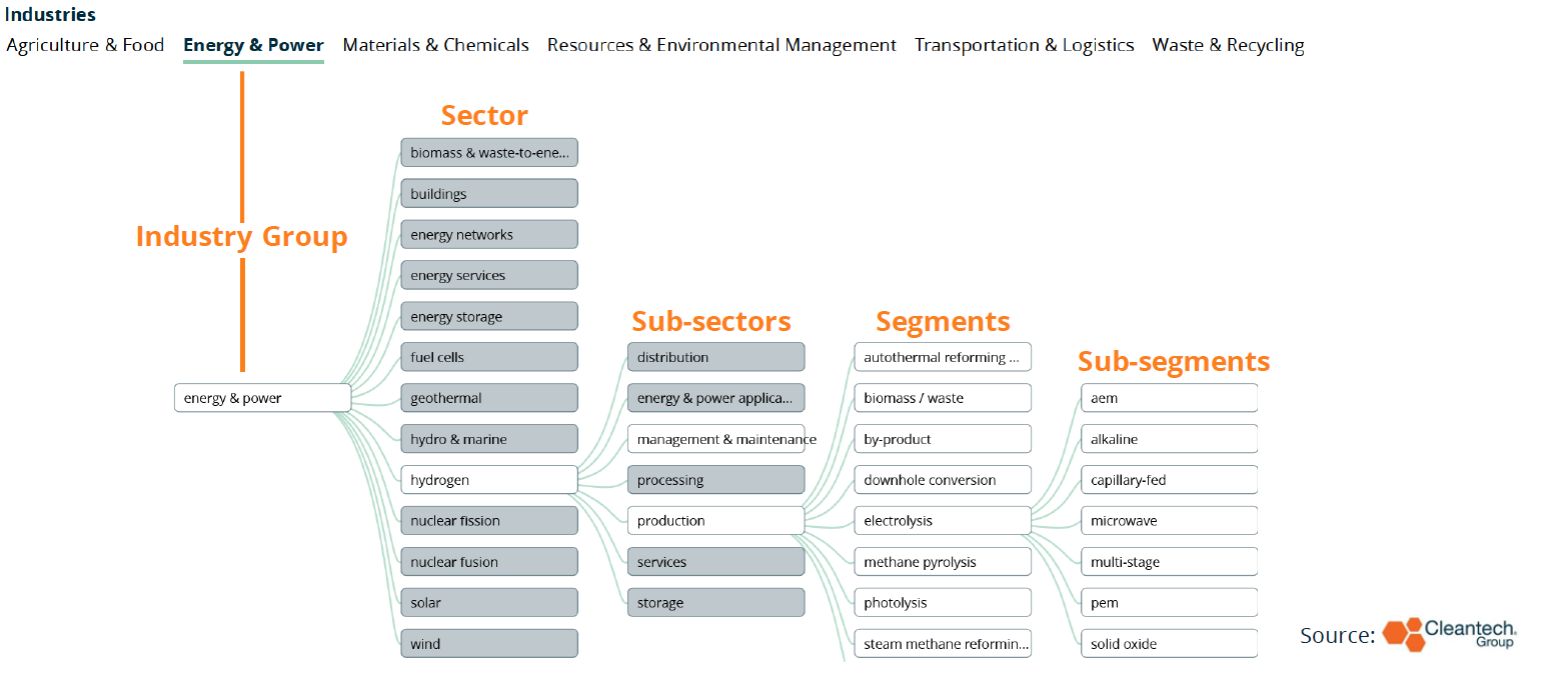

The Cleantech Group taxonomy is comprised of 6 industry groups:

A Sector is a category that breaks the industry group into mutually-exclusive technology buckets

Sub-sectors unpack the various product and service types

Segments identify the types of technological approaches to delivering the products or services in sub-sectors

Sub-segments land on the specific technologies used in the segment-level delivery of products and services

Companies are “tagged” using sub-sector, segment, or sub-segment categorizations

The taxonomy is actively managed to reflect our analyst’s views in real time

- Analysts occasionally remove from the taxonomy categories technology that we do not yet believe offers a proven case for resource reduction or do not themselves innovate new technologies

- Analysts occasionally re-tag companies to create a more accurate reflection of that company’s activities

In an effort to keep our network informed of how our view has changed, we release changes to our taxonomy every quarter, and explain how these changes are reflected in the data that we report to the world.

We research these industry groups and their cross-cutting underlying enabling technologies with a focus on sustainable innovation:

Technologies and services that make the production of food more efficient and effective

Read the Latest Blogs in Agriculture & Food

See the Innovators Leading the Way in Agriculture & Food:

“Looking forward to 2024, alternative proteins will likely continue to attract a substantial share of Agriculture & Food funding. However, expect more of that capital to go to B2B players making ingredients, consumables, or infrastructure for alternative protein production…”

Jack Ellis, Senior Associate

Technologies, services and business models that accelerate the transition to renewable energy and optimize existing processes.

Read the Latest Blogs in Energy & Power

See the Innovators Leading the Way in Energy & Power:

“With $18.2B of venture capital into [Energy & Power] technologies, 2023 saw the second highest year in terms of investments since Cleantech Group started recording this data.”

Selene Law, Senior Associate & Zainab Gilani, Associate

Innovations which enable the efficient production of basic materials such steel, cement, and chemicals, or advanced materials used in other cleantech sectors

Read the Latest Blogs in Materials & Chemicals

See the Innovators Leading the Way in Materials & Chemicals:

“2023 saw strong development in the deployment of green steel production technologies. Leading the way is the production of hydrogen direct reduced iron which will add to demand for renewable energy and green hydrogen technologies.”

Ian Hayton, Group Lead

Technologies and services to protect and restore natural environments, sustainably source materials, prevent waste, improve the circularity of materials, adapt to climate change, and assess corporate environmental impact, carbon, and offset markets

Read the Latest Blogs in Resources & Environmental Management

See the Innovators Leading the Way in Resources & Environmental Management

“2023 saw an uptick in investment across the critical materials supply chain, with technologies such as direct lithium extraction (DLE) and battery recycling seeing more market traction, while regulatory pressures and high-water risks drove investment into wastewater management and treatment technologies.”

Holly Stower, Group Lead

Vehicles, technologies and services that move people and goods with zero or low emissions, or in a more resource-efficient way

Read the Latest Blogs in Transportation & Logistics

See the Innovators Leading the Way in Transportation & Logistics:

“As the energy demand increases from newly electrified fleets, commercial vehicles such as transit buses and heavy-duty freight vehicles, charging and energy management solutions will be critical to stabilize grids, allow utilities to meet consumer power demands, and avoid extensive grid upgrades.”

Nicole Cerulli, Associate

Technologies to manage waste in an environmentally sound manor, compared to traditional methods

Read the Latest Blogs in Waste & Recycling

See the Innovators Leading the Way in Waste & Recycling

“2023 saw a downturn in deal amount back to pre-2021 levels — whilst deal number remained relatively static.”

Holly Stower, Group Lead