Battery and Energy Materials Innovation Underpin Historic Highs in Cleantech Investments in Asia Pacific

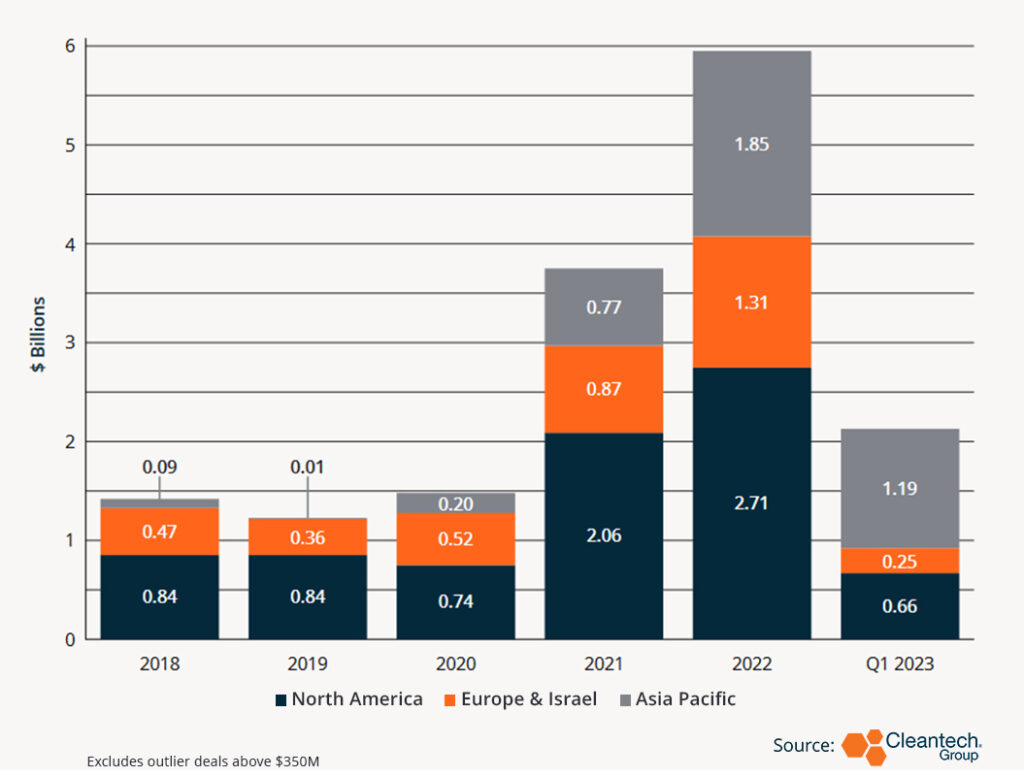

In last year’s APAC Cleantech 25 report (launched August 31, 2022) we noted that, while venture and growth investments in Asia-Pacific cleantech were continuing at the same pace as in 2021, they lagged the growth rates seen in Europe and the U.S. This dynamic has reversed in recent months as APAC saw a Q1 2023 that outpaced the entire second half of 2022 (download our APAC Cleantech 25 report, published in April 2023).

In the first three months of the year, companies in the region raised 30% of what they’d raised in the whole previous year (by comparison, North America, and Europe & Israel companies raised 14% and 17% of their 2022 totals, respectively).

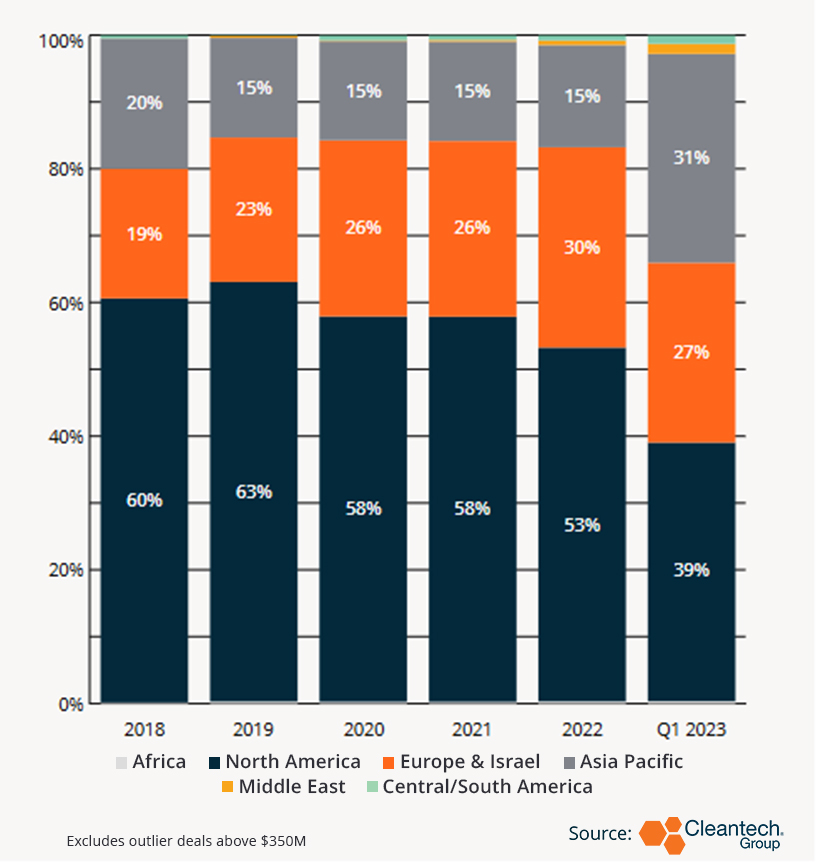

While APAC cleantech innovators mostly held steady at around 15% of overall global cleantech venture and growth investment over the past 5 years, that jumped to over 30% in the first quarter of this year.

Regional Percentage of Cleantech Venture Investments 2018-2023 Q1

APAC Energized by Global Shift to Electrification

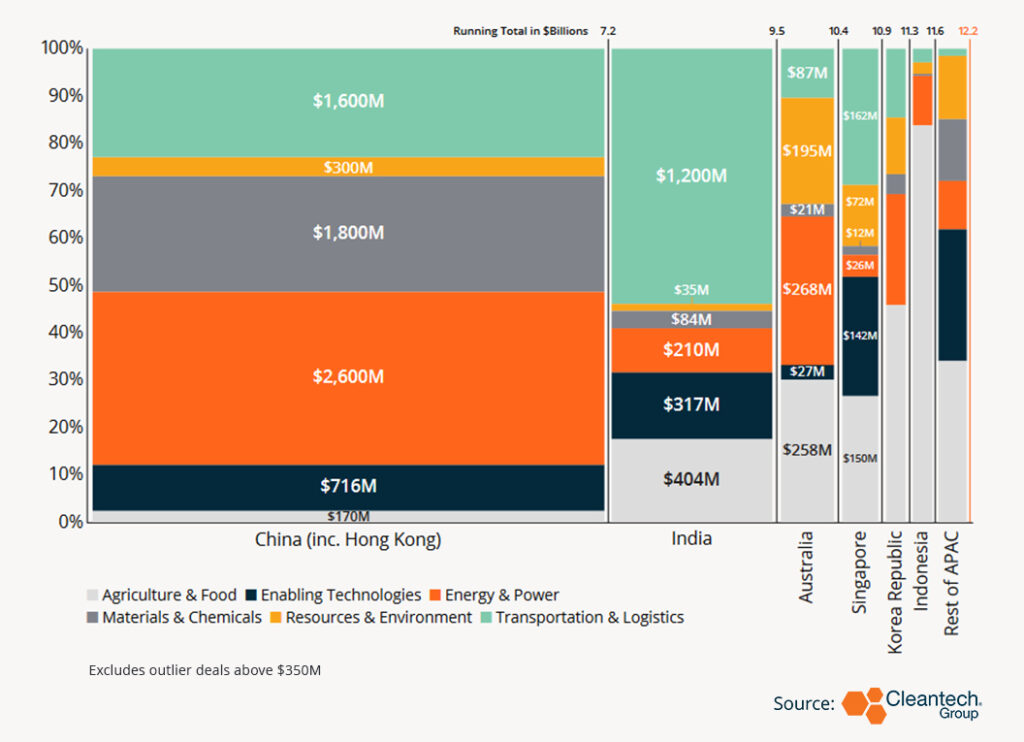

We noted in the 2022 APAC Cleantech 25 report that investments in the region were mostly underpinned by consistent enthusiasm for Transportation & Logistics technologies. While this is still the case, last quarter, APAC mirrored a global trend in that Energy & Power investments now comprise a significantly larger percentage of overall funding than in recent years. Energy & Power has been the engine for growth in APAC over the past two years, compensating for a drop-off in Enabling Technologies investment.

Within the APAC region, China remains the dominant source of Energy & Power innovation, comprising just under 60% of all cleantech fundraising. China’s substantial activity in energy storage (which is now moving beyond just lithium-ion) has enabled the region’s shift toward more upstream energy and materials innovation strength versus what was previously mostly downstream applications in vehicles and mobility services.

Cleantech Venture Investments in APAC 2022-2023 Q1

In India, there is still significant activity in electric mobility, as homegrown electric solutions such as electric three-wheelers (2021 APAC Cleantech 25 company Euler Motors, India) and scooters (2018 APAC Cleantech 25 company Ather Energy, India) raised rounds upwards of $60M in the past 15 months; but some early cases in battery materials companies (2021 APAC Cleantech 25 company Log 9 Materials, India) attracting global investment may offer an indication of things to come.

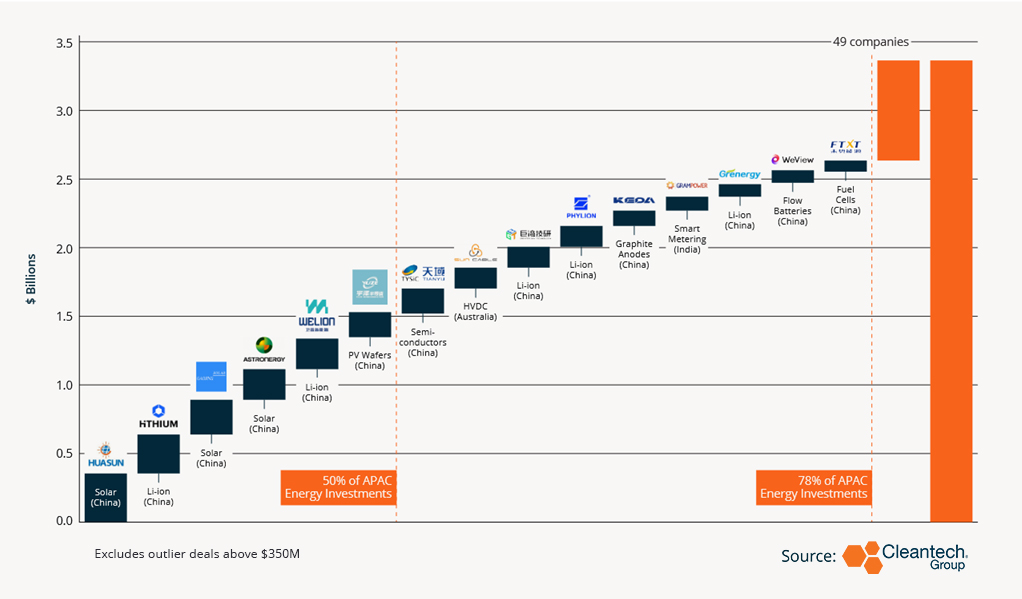

The themes of energy prominence and China dominance are likely not hype, as we begin to see consistent trends emerge: From 2022 until the time of publication in April 2023, the top 15 APAC recipients of venture financing in Energy & Power took home 78% of venture funds invested, out of a total of 64 companies. Seven of those companies are in some area of the energy storage value chain and four are in solar. Six companies took home over 50% of all venture funds (and those six are all in China).

APAC Energy & Power 2022-2023 Q1 – Companies Raising Venture Funds

APAC’s Energy Storage Advantages Solidify Further

The story of the past 15 months in APAC has mostly been energy storage — between January 2022 and March 2023, 80% of $3.3B in APAC energy venture investments went toward advanced energy materials (43%, $1.4B) or energy storage (37%, $1.2B).

Lithium-ion innovation in China continues to show its strength in scale. Companies like Hithium (China) are rolling out grid-scale and shipping container-sized lithium-ion batteries enabling grid balancing capabilities for customers, while WeLion (China) and Greater Bay Technology (China) are angling for denser and faster-charging EV batteries.

Upstream from scale applications, there has been action in battery materials in China over the past year or so, including innovative solutions in lithium-ion and solid-state electrolytes (2023 APAC Cleantech 25 company Liongo, China), anodes (KEDA, China), and binders for anodes and cathodes (Haodyne, China).

EV battery recycling innovation is picking up as well. Singapore has been a recent zone of activity, seeing advances in recycling technology from companies like Green Li-ion (a 2022 APAC Cleantech 25 company, Singapore), and now LFP-specific recycling from NEU Battery Materials (a 2023 APAC Cleantech 25 company, Singapore).

For perspective, as recently as three years ago we highlighted APAC as significantly lagging the U.S. and Europe in venture investments toward energy storage and advanced energy materials. And while we’ve seen APAC investments increase in line with overall global expansion, APAC’s growth has been most notable in recent years and, if Q1 of 2023 is any indication, it will be considerable this year as well.

Venture Investments in Energy Storage and Advanced Energy Materials, 2018-2023 Q1

We have also observed an uptick in venture investments put toward forms of long-duration energy storage (LDES), principally to vanadium flow battery technologies including VFlow Tech (Singapore), H2 (a 2023 APAC Cleantech 25 company, South Korea) and Standard Energy (South Korea), but also zinc-iron flow company WeView (China).

This is likely not a coincidence — flow battery projects for long-duration (10+ hour) grid balancing have been steadily popping up in APAC over the past year and a half, including the world’s largest vanadium flow battery project in Dalian, China and a 2022 Sumitomo launch of a vanadium installation at a Hokkaido wind farm.

The Electric Mobility Value Chain Reaches Maturity

While we have covered for years the fast development and scale of charging, battery swapping, and the shift of mobility services to electrification, in the past 15 months we’ve seen double the venture investment activity in on-road vehicle innovation versus charging ($1B in on-road vehicles versus $448M in charging). Some of this is attributable to the trend of Chinese upstart automakers continuing to raise significant growth equity rounds, including Hozon Automotive (China) and AIWAYs (China); but also new interest in electric trucking (Deepway, China).

While China has long-dominated APAC in terms of electric 4-wheel vehicle innovation, India has come into the frame with more localized land vehicles (TI Clean Mobility, Euler Motors, and 2021 APAC Cleantech 25 company Three Wheels United, all in India) and small-format electric logistics vehicles (2023 APAC Cleantech 25 company Magenta Mobility and Altigreen, both in India), but also electric aviation (Bee Flights, India).

Localized approaches to personal transportation have continued to roll out across South and Southeast Asia. Electric motorcycle companies, especially, are picking up momentum, including Ion Mobility (Singapore), Ultraviolette (India), and Alva (Indonesia), who have all raised venture funds in the past 15 months.

Operating Lean Amid Hot Demand

As most of the world settles into post-Covid 19 economic patterns, we can expect to see fewer question marks about when and whether industrial operations will come back online, and more questions about who can outlast the competition in the near-term during a tightening economic climate. We predict the theme for cleantech innovators over the next year will be operating lean in a hot demand market (where industrial shifts are underway and policy pushes for further shifts).

Some previous niche sectors are now very mainstream (electric vehicles, distributed energy) and previous long-term goals are now snapping into the near-term frame (decarbonizing long-distance shipping and heavy industry). Indeed, while APAC innovators have for years now presented strong competition for global clean technology suppliers in the scale wars, APAC competitors in the long shots are now emerging too. Cleantech innovators who hope to win — not just in the 2020’s, but into the 2030’s — now must keep an eye on APAC as not only a business destination, but an arena of competition.

We invite you to download our 2023 APAC Cleantech 25 report, to learn more about the global cleantech trends being impacted by innovators in the region.