Can Plant-Based Protein Ease Livestock’s Environmental Burden?

The livestock industry accounts for approximately 11% of global greenhouse gas emissions while also using huge amounts of fresh water and causing soil erosion, pollution, deforestation, and antibiotic resistance. As global protein consumption is projected to increase by 14% by 2030, sourcing alternative proteins with reduced environmental impacts has become a priority.

In the last decade, businesses, mainly in Europe and North America, have launched a vast array of plant-based protein products, with consumer demand totaling $6B a year. If this industry is to expand to meet global protein demand, though, the entire plant-based value chain must adapt to improve product offerings and drive down prices.

Plant Protein Innovations

The most mature market within alternative proteins is plant-based protein; more specifically, meat analogs that mimic animal-derived meat products and require intensive processing while being manufactured. Areas of innovation needed to improve production efficiency and meet consumer expectations include:

- Ingredients: Genetically enhanced crops edited using CRISPR or ODM, and selective breeding methods, for increased protein yields and desirable manufacturing qualities

- Prototyping: Rapid formulation prototyping through incorporation of 3D printing and shear cell testing for texture while implementing machine learning for ingredient selection

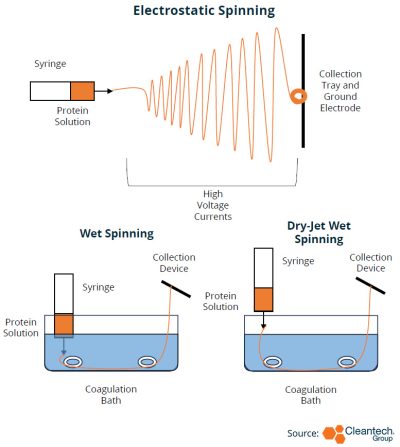

- Manufacturing: Advancements through modular extrusion units for production flexibility and spinning techniques for improved textures and scaling

Innovation in these three areas ties into a larger theme of reducing costs while improving product offerings. Plant-based meat is not constrained to a single production process, so innovators providing novel or optimized technologies can find success by slotting into a larger production chain, often at the prototyping phase. Importantly, manufacturing technologies such as extrusion, 3D printing, and dry-jet wet spinning, amongst others, are increasingly used together while companies test, develop, and scale production of a single product.

Increasingly, start-ups are looking beyond traditional extrusion technology, which has limited abilities in terms of textural variety and product differentiation. Smaller start-ups are now empowered to experiment with emerging technologies, often from the university setting, with higher capital costs but potentially lower operational costs and more production flexibility, resulting in higher quality products. Larger start-ups that use established extrusion plants continue to operate in this way but have recently began partnering with smaller start-ups to outsource aspects of production such as testing, ingredient processing, or prototyping.

Plant Protein Innovator Spotlight

- AgGene: A genetics research company, AgGene is expanding into retail partnerships as their first batch of protein-enhanced crops including rice and chickpeas finalize regulatory testing. Working alongside the University of Calgary, AgGene has secured several IP protections for its high-protein crops and provides ingredient and consulting services to plant-based protein manufacturers.

- Project Eaden: The protein spinning company recently extended its seed round and announced construction of its first commercial production facility. Project Eaden is aiming to improve plant-based meat textures and incorporate multiple versions of protein spinning in its ‘whole cut’ products.

- NovaMeat: This innovator has found tremendous success in incorporating several technologies such as microextruders and 3D printing within its manufacturing process to achieve 10x cost reductions compared to commercial grade extrusion.

Plant Protein Trends and Long-Term Outlook

Commercial success in the plant protein industry is changing rapidly. While Beyond Meat and Impossible Foods found great success by being first to market and expanding through retail, plateauing consumer demand is forcing change. Plant-based meat end-pricing may be too high at 43% higher than animal-derived counterparts. In addition, consumers generally consider taste and texture of plant-based analogs as inferior to animal-derived protein, particularly for beef and seafood substitutes.

Companies boasting process innovations like Project Eaden’s or Life3 Biotech’s spinning technologies are taking more time to validate the scaling potential of their processes before moving to full commercial production.

Plant protein start-ups are partnering across the food and beverage space with spinning companies conducting joint research with cultivated meat producers, extrusion companies hiring innovators like NovaMeat to handle prototyping, or NotCo creating powerful artificial intelligence models with world-class chefs, fast food chains, and, most recently, food conglomerate Kraft Heinz.

Public investment remains varied in scope and focus with some countries like France appearing to prioritize animal agriculture over meat analog manufacturing while Canada is directly scaling its plant-based protein processing capabilities. Universities are driving technology innovation due to large grants for research in countries like Australia, Britain, and the U.S.

Singapore’s bet on plant protein and cultivated meat is generating new possibilities for animal-free products created by blending technologies such as electrostatic spinning and culturing fat cells. All these examples point to a correlation between successful plant protein markets and direct public investment, a trend that will be crucial for governments and start-ups in Asia Pacific and Latin America.

Plant-based protein has reached the end of its first market lifecycle. With a firm consumer base on several continents, the industry now requires intense innovation to reduce production costs and diversify product offerings.

Future market growth is reliant on:

- Some level of acceptance of gene-editing technologies to develop protein-optimized crop varieties, as well as exploration of alternative crops.

- Driving down manufacturing costs to maintain price parity with animal products.