Cultivated Meat Slashes Emissions

Animal agriculture is critical to human survival and wellbeing. The farming of livestock, including land-based animal husbandry, ranching, grazing, and aquaculture, supplies around 26% of humanity’s protein needs. But it’s also responsible for between 10% – 20% of global greenhouse gas emissions, according to The World Bank.

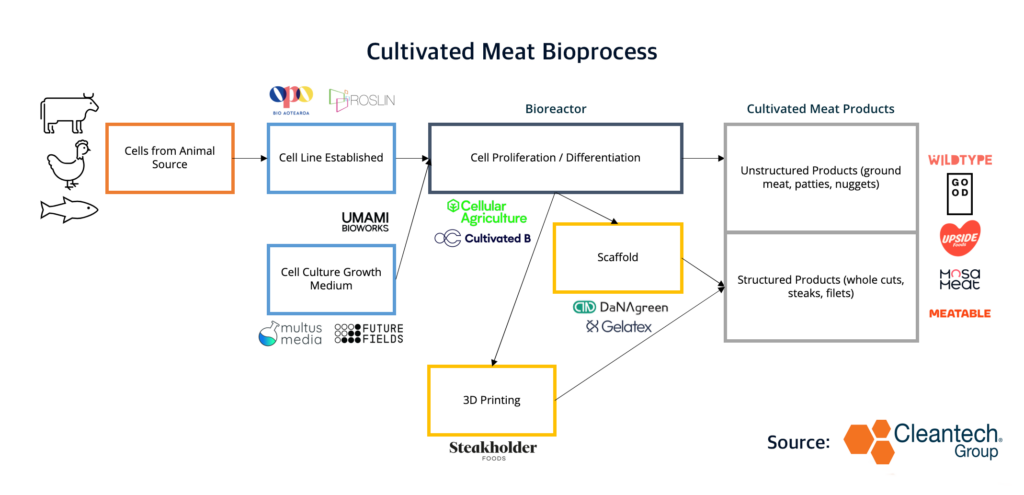

Cultivated meat – also known as cell-cultured protein or, often pejoratively, as lab-grown meat – is a technology that enables the production of animal proteins without the need to raise, farm, and slaughter animals, by growing edible tissues from isolated animal cells in a bioreactor environment.

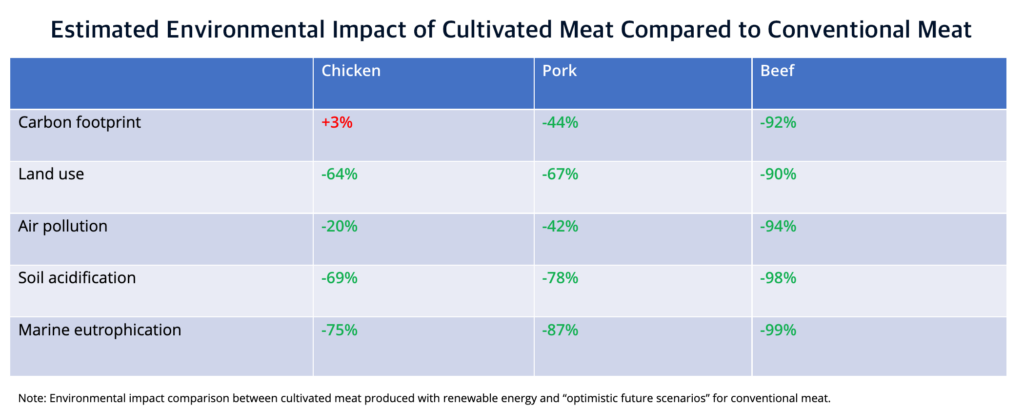

Cultivating animal protein in this way rather than by livestock production would slash the emissions profile of meat by as much as 92%, according to one review of life cycle assessments. It would also substantially reduce other negative environmental impacts including air pollution and soil and water degradation.

However, cultivated meat production costs remain exceedingly high, and the technology is still largely limited to research laboratories and a handful of pilot facilities; a far cry from the commercial-scale manufacturing that would be required to replace even a small portion of the livestock industry.

Moreover, cultivated meat technologies and products typically fall under the purview of novel food regulations, and must obtain approval before being sold or served to consumers. To date, only two jurisdictions (Singapore and the U.S.) have cleared cultivated meat products for public consumption; these approvals cover products from two companies, Upside Foods and Eat Just, which nevertheless are not on general sale in either territory due to the economic unviability of producing them at such a scale.

Even the most optimistic estimates for cultivated meat end-products put a 9-10x premium on prices for conventional animal-derived equivalents, based on current expectations.

Key cost drivers for cultivated meat and seafood production include:

- Growth media: The nutrient-rich input that enables isolated cells to grow and proliferate. The most expensive media components include growth factors and recombinant proteins. Historically, animal serum, which is extracted from the blood of slaughtered animals, has been used here because it contains all of the required nutrients. However, it is exceedingly expensive – and as a product of the slaughterhouse industry, it kind of goes against that ultimate objective of alternative protein, which is to displace at least part of the animal agriculture industry.

- Bioreactors/cultivators: These provide the environment in which cells can proliferate and be differentiated into muscle, fat, etc.

- Water management and wastewater treatment

Given the above, much of the innovator and investment activity in this space is focused on bringing down the costs of production. Different approaches include:

- More affordable and more sustainable components for growth media, produced via technologies such as plant molecular farming, precision fermentation, or insect farming (e.g., Tiamat Sciences, Bright Biotech, Future Fields, Integriculture).

- Using AI/ML to optimize production processes and media formulations for affordability and sustainability (e.g., Multus Media).

- Designing lower-cost cultivators, processes, and infrastructure (e.g., Cellular Agriculture, The Cultivated B).

- Cheaper and more sustainable scaffold materials from algae and plant sources, allowing more end-product differentiation in terms of texture and appearance (e.g., Gelatex).

- Alternative approaches to texturization, such as 3D bioprinting (e.g., Steakholder Foods).

Shifting Upstream Focus

In years gone by, venture funding typically flowed to cultivated meat innovators positioning themselves as vertically integrated companies handling production and consumer-facing brand marketing.

But given the cost and regulatory constraints, more innovators are emerging which fulfill a B2B role, providing ingredients, consumables, or production technologies to innovators and incumbents focused on making end-products.

This has also heralded increased convergence between cultivated meat and other fields within the broader alternative protein sector: plant-based and fermentation-derived products. In many cases, these different technological pathways present cost, production, or quality advantages over each other in specific areas; for example, producing growth factors via precision fermentation, or using cultivated fat cells in a plant-based end-product to enhance consumer experience.

Corporate Involvement

It is notable that several of the world’s largest meat and dairy companies have engaged in venture investment, M&A, or collaborative activity to secure a foothold in the cultivated meat industry, despite it still being in a pre-commercial stage.

- JBS, the world’s largest meat processor, has set itself a net-zero by 2040 target; as well as aiming for a ‘no-deforestation’ supply chain by 2025. It acquired Spanish cultivated meat innovator BioTech Foods last year for an estimated $59M, while also committing $41M to establish a cultivated meat R&D center in Brazil.

- Tyson Foods, the second-largest processor and marketer of beef, chicken, and pork globally, has invested in several cultivated meat start-ups, including Believer Meats, Omeat, and Upside Foods.

- Nestle has typically been more active in the plant-based and fermentation spaces but they partnered with Israel’s Believer Meats in July 2021 to “explore the potential of cultivated meat components.”

Looking Ahead

We expect to see a continuation of the trend of more funding channeled towards B2B models and technologies that are looking to solve the production bottlenecks in cultivated meat. Investors are taking a longer-term perspective, shifting attention from consumer brands and products further upstream to back fundamental technologies that could help make cultivated meat end-products a reality.

As more breakthroughs are made on production costs and more regulatory approvals are issued across the world, ‘big meat and dairy’ corporates are likely to continue boosting their presence in the cultivated meat space.