Direct Lithium Extraction: New Technologies to Disrupt Traditional Refining and Mining

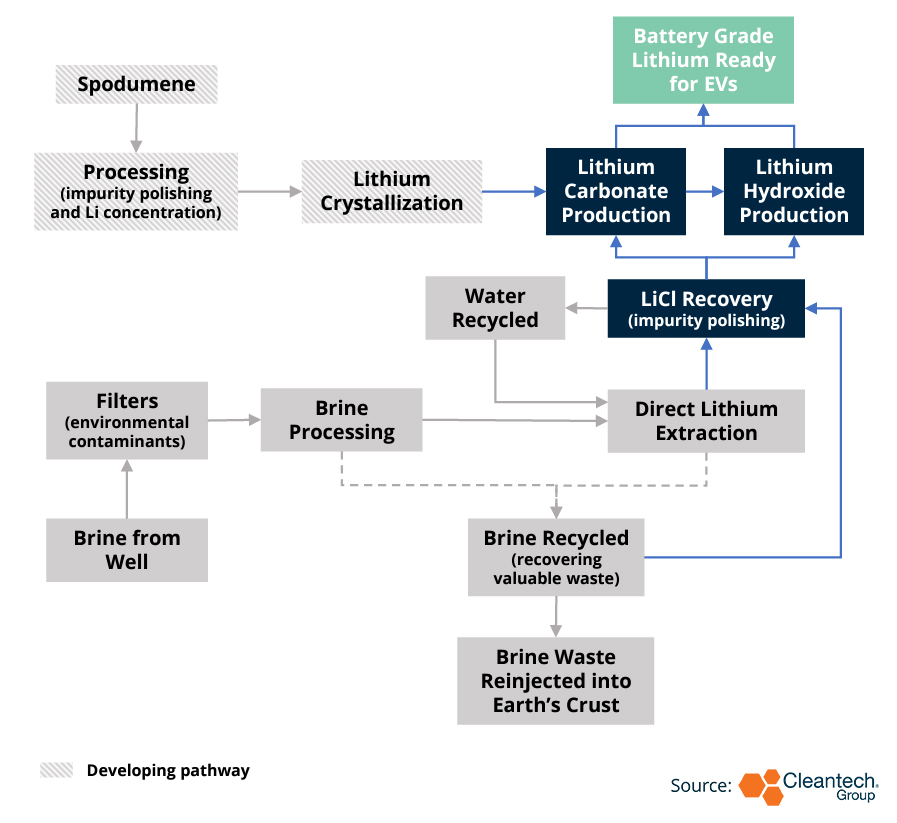

Lithium is an essential building block of the low-carbon economy, particularly for energy storage and electric vehicle (EV) batteries (Figure 1). Due to its unique properties and lack of alternatives, the global demand for lithium is predicted to rise over 40 times by 2040. However, to meet this demand, lithium mining and refining need to scale in tandem.

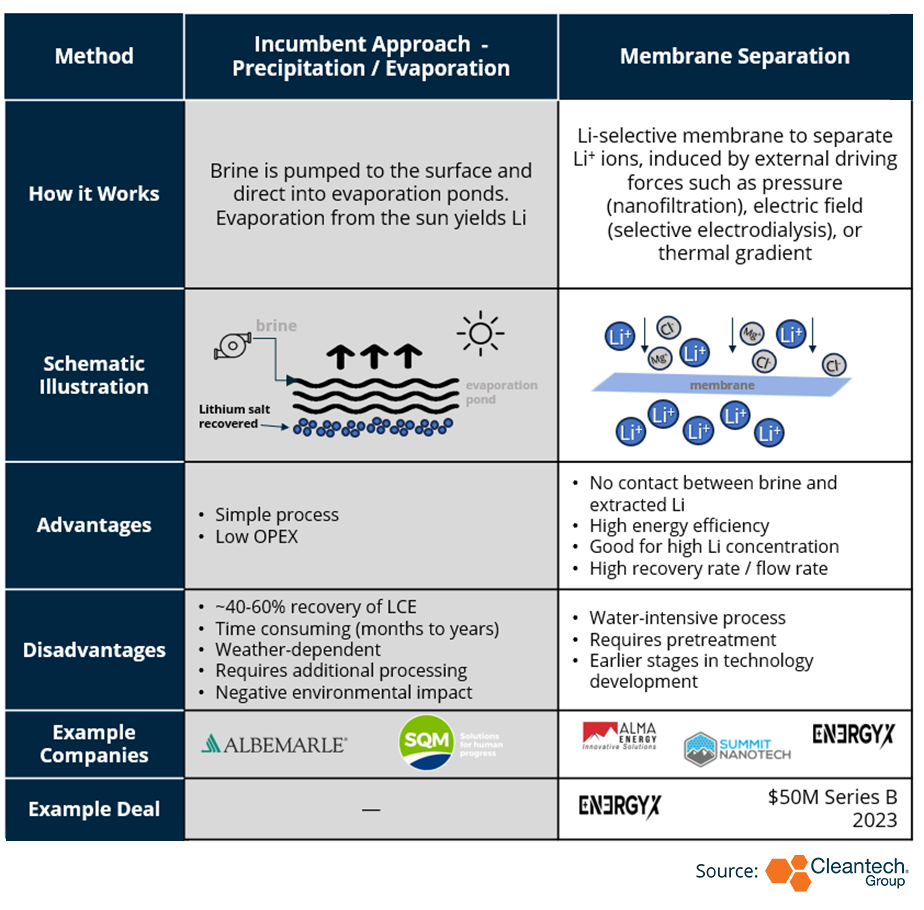

Current methods of extraction and processing are slow and resource intensive. Brine is pumped to the surface and into evaporation ponds. Evaporation from the sun refines and yields lithium. This process can take months to years and require large amounts of land and water and it causes air and water pollution.

Figure 1: General Direct Lithium Extraction Process

DLE Presents Improved Process Efficiencies

Direct Lithium Extraction (DLE) is disrupting traditional practices, reducing carbon, time, and costs:

- Innovators claim reduced emissions of 50% compared to traditional lithium refining (e.g., Summit Nanotech).

- New DLE techniques reduce and recycle water. The water required to process one metric ton (mT) of lithium carbonate equivalent (LCE) is:

- Evaporitic ponds: < 2200 mT water

- Livent: 71.4 mT water

- Lilac Solutions: 10-20 mT water

- Evaporitic ponds: < 2200 mT water

- DLE is cost-competitive with traditional methods when adjusted for greater yields (<90%).

- DLE also provides flexibility and gradual scaling to meet demand which smooths variable costs of operations.

- DLE can access lithium brine deposits that make up <66% of global lithium resources but remain largely untapped.

- Modular designs enable production to begin in months and are compatible with existing infrastructure.

DLE innovations are using sorbents, electrochemical, membrane, and ion exchange technologies. Each has positives and negatives, as well as trade-offs. For example, membrane separation is good for feedstocks with high lithium concentrations and is energy efficient but is water intensive and in earlier stages of development (Figure 2).

Figure 2: General Direct Lithium Extraction Process

DLE Innovators

At present, DLE is entering commercial pilot phases with commercial-scale production expected by 2025 from innovators.

Summit Nanotech is a producer of lithium from brine water using advanced nanomaterials which can extract upwards of 90 – 99.9% material.

- January 2023: Raised $50M in Series A funding to scale resource-base in Canada

- June 2023: Building technology scale-up center in Santiago, Chile

With healthy demand signals for EVs, innovators and DLE incumbents are entering off-take agreements with automotive OEMs and getting dilutive investments as the OEMs look to secure a localized supply of battery materials to scale EV manufacturing.

- April 2023: GM Ventures led EnergyX’s $50M Series B round for technology development, which included an offtake agreement for lithium for EV production.

- March 2021: Livent entered an off-take agreement with BMW, where Livent will supply the lithium directly to the BMW Group’s battery cell manufacturers which began in 2022. The value of the multi-year contract will total around 285M EUR ($345M).

The DLE market is highly competitive, with limited geographical locations of lithium reserves, strong incumbents, and a handful of miners or mine owners to sandbox technologies and scale DLE innovations. Strategic mergers are occurring between tech developers to share expertise, maintain value, gain control over a competitive landscape, and compete with major miners.

- May 2023: Incumbents Livent and Allkem announced a definitive agreement to merge, with the combined company valued at $10.6B.

February 2023: Tevano acquired , a developer of direct lithium extraction technology for brine and pegmatite mines (hardrock) via solvent extraction / precipitation, for $1.14M.

What to Watch

- DLE technology will bring access to more supply at a rate that is approximately twofold that of current production while also stabilizing lithium prices and reducing the environmental impact of lithium.

- Innovator partnerships with corporates and major miners are delivering DLE on faster timelines benefitting from mine access, funding, and enabling iterative technology development.

- We expect considerable consolidation between innovators, incumbents, and major miners across the lithium supply chain as they compete for supply chain ownership.

- DLE will reduce the need for additional processing and alternative mining sources which have an unknown and likely greater environmental impact, e.g., deep-sea mining.

As the DLE industry commercializes, we expect continued consolidation between innovators, incumbents, and major miners across the lithium supply chain as they compete for supply chain ownership.

In terms of the winning ingredients for success from innovation, we expect some DLE technologies to be uneconomical at commercial scale, either through underperformance (time or recovery rate) or increased OpEx (sorbents or energy).

This is a rapidly changing market and one which bets will continue to be placed across the lithium value chain with a ripple effect on the wider critical materials supply chain.

Buff Lopez, Research Analyst at Cleantech Group, discusses how Direct Lithium Extraction (DLE) is disrupting traditional practices, reducing carbon, time, and costs.