Energy Flexibility: Emerging Revenue Opportunities for the 2020s

For a rising number of days each year, countries are beginning to deal with the next big challenge in the clean energy transition. How can we address the significant imbalances between renewables supply and electricity demand without taking on huge costs and without resulting in drastic power system failure? In Australia and California, oversupply has already caused significant issues, resulting in negative market pricing and forcing the temporary shutdown of large renewable generation fleets.

As the number of countries with medium-to-high shares of renewable energy rises, volatility and grid instability are becoming a prominent global issue. In fact, Project Drawdown believes growing beyond a 25% share of renewable energy will be technically impossible without increased grid flexibility.

Traditionally, large network infrastructure projects have been the obvious solution for grid operators and utilities. However, as lower costs for renewables and energy storage drive up distributed energy resources adoption, demand-side practices and technologies are becoming go-to solutions for strengthening grids. In fact, the UK’s 2023 price control period requires any grid infrastructure upgrade above $1.34 million to show evidence a flexibility-based alternative solution is not a reasonable option.

A market coming of age

In 2021, economically valuable opportunities to play in the flexibility space are opening. In particular, this is true markets such as the UK, Japan, and California where:

- Market design

- High renewable penetration

- Grid imbalances and capacity shortfall are driving the need for innovation.

Over the last decade, many companies in the space struggled to generate sufficient returns by providing and managing flexibility. In the 2020s however, innovators will be able to tap into a diverse set of highly profitable revenue streams as countries ramp up renewable energy deployment to reach ambitious 2020 climate targets. Early-market entrants such as AMS (now acquired) and STEM (now looking to go public) pivoted away from providing and operating flexibility infrastructure. Instead, their focus is more on multi-asset software services to address the broad set of valuable markets globally, each with diverse requirements and distinct market characteristics globally.

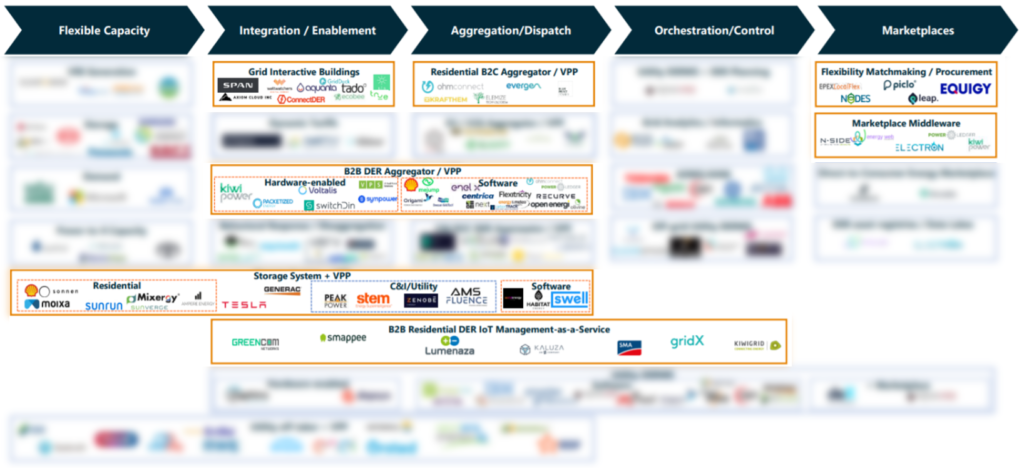

The value chain below highlights the diverse set of business activities at play in 2021, which include:

- Providers of flexibility capacity, utilizing renewable generation, storage and load capacity

- Grid-edge technologies and services unlocking the ability for flexible capacity to balance the grid

- Technologies and services aggregating and dispatching fleets of flexible capacity from the bottom-up for economic optimization in wholesale and distribution markets

- Technologies and services for managing distributed energy resources from the top-down, helping grid operators predict and manage energy assets.

- Platforms to enable revenue streams for other flexibility providers.

Distributed energy flexibility value chain

Three emerging areas of innovation to watch in the space:

- Grid Interactive buildings

In the latest evolution of demand response, technologies such as smart thermostats, building management systems and HVAC systems are enabling building-to-grid asset integration, responding to dynamic electricity prices and/or other grid signals in real-time. Innovators are introducing smart technologies to enable demand-side flexibility, co-optimizing for energy cost, grid services, occupant needs and preferences, in a continuous and integrated way.

Innovators including SPAN, Greencom Networks, ConnectDER and WattWatchers have introduced DER-enabling IoT hardware to manage and to connect building assets, providing visibility/control at the grid edge. Standardization of data between DERs and grids remains a bottleneck, as many capacity providers work with different components and standards. Bringing the data together in a systemic way provides the opportunity to open new grid revenue streams. Building automation management players (75F, Encycle) and HVAC appliance controllers (Tado, Switchee) are also able to take on the role of flexibility enablers, driving automated demand response services.

2. Residential DER aggregation

DER aggregation uses virtual power plant software/hardware to aggregate renewables, storage, and controllable loads, forming a single power plant which can be dispatched during times of peak demand. Given the increasing adoption of home solar + batteries, aggregation service providers and technology developers, innovators are developing businesses to tap into residential assets to balance supply/demand.

Acting as a direct competitor to back-up power generation, innovators are differentiated based on the ability to dispatch different utility profiles, and generally include advanced-AI driven features to forecast supply/demand utilizing large data sets, machine learning and cloud-based systems

Although only valued at $762M in 2019, a set of large projects exist which are proving when scaled up, the model can be a viable and profitable alternative to traditional power plant investments. A few examples include:

- OhmConnect’s $100 million 550MW Resi-Station demand response virtual power plant announced in December 2020, which in partnership with financer Sidewalk Infrastructure Partners dispatch the load of 150,000 active customers in California to deliver capacity to the wholesale market and utilities.

- Moixa’s 220MWh virtual power plant in Japan in partnership with storage system provider ITOCHU. The system brings together 22,000 residential storage systems, and is optimized based on battery behaviour, weather, and market prices.

- Tesla’s South Australia’s virtual power plant using the corporate batteries and solar systems, which is expected to connect 50,000 homes to meet 20% of South Australia’s daily power demand. When up and running, the VPP will provide the lowest residential electricity rate in South Australia ($22 lower than default rate).

3. Flexibility Marketplaces

Flexibility marketplaces are emerging as B2B flexibility matching services, allow different types of flexibility to compete on a level playing field, where the right type of flexibility can be procured at the right price, in the right location at the right time. Connected to national energy markets, these marketplaces actively orchestrate DER-grid interactions to enable day-ahead, intraday, long-term, and short-term transactions, and have potential in countries where flexibility demand is high.

Uniquely positioned, the UK is leading commercially. Independent marketplaces operators have emerged, acting as neutral market facilitators, registering, tracking buyers and sellers, bidding directly into wholesale markets. The market for flexibility tenders, launched by grid operators to procurement flexibility to reinforce grids, has enabled innovator Piclo to become a key national player, providing the world’s first commercially available B2B flexibility marketplace.

Grid operators are also working with innovators to develop and pilots’ similar models in-house. Scottish and Southern Electricity Networks, Local Energy Oxfordshire pilot is exploring how the growth DERs can be supported by local flexibility marketplaces, with partner Opus One Solutions who is providing two DER marketplaces; a “Neutral Market Facilitator” platform to register and track buyers and sellers of flexibility; and a “Whole System Coordinator” platform to determine the grid need’s in real-time.

The model is also beginning to take shape in Europe. Piclo just raised equity funding to expand into Europe, and Equigy, a transmission system operator-owned marketplace was recently launched to cater for the Europe market. In the US-innovator Leap has also gained momentum in California and Texas, providing a flexibility marketplace, bidding flexible capacity into wholesale markets, and addressing state-wide capacity shortfalls.

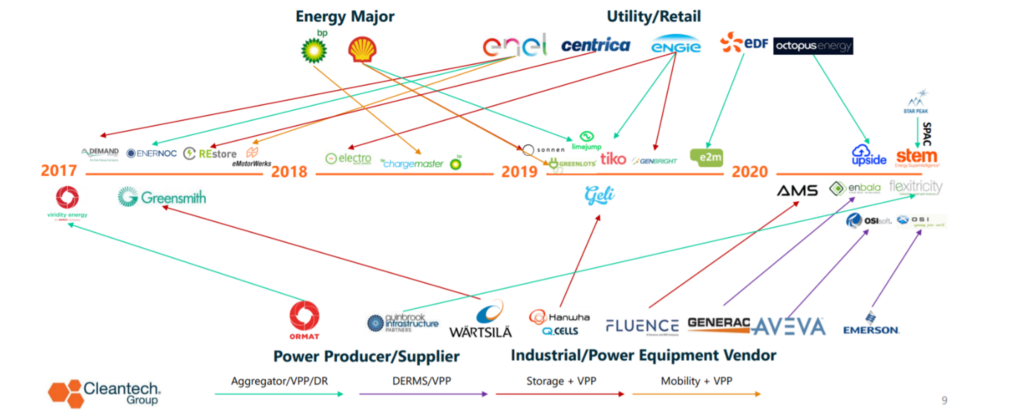

Where are corporates in all of this?

To capitalize on the emerging value-steam, energy corporates, utilities and equipment manufacturers are investing in and acquiring technologies directly related to demand-side flexibility as they move downstream to integrate deeper with end-customers. As shown in figure 4, corporates’ route to market involves in-house development or acquisition of storage, and smart charging or multi-asset aggregation start-ups. In fact, there are few DER aggregation start-ups left in the market today that are not yet owned by or tied to a large corporate in one way or another. Market consolidation has been a trend of the last few years and will likely continue into this decade as vertically integrated, flexibility management competency becomes a must have, instead of a nice to have.

Ones to watch

Corporate M&A Activity

Corporate M&A Activity

Today’s profitable innovators in the flexibility space are tied together through wholesale/distribution markets or bilateral contracts to serve individual customers. The tie to wholesale markets enables grid operators to remain important in the supply chain, enabling national-scale cost optimization and maximal market liquidity. However, this decade, regulatory changes may mean it becomes viable to run many localized energy markets consisting of networked DERs and storage, where energy is shared among local users optimized for local value. Peer-to-peer energy trading models which operate independently from utility-run grids have been piloted to varying levels of success globally (LO3 Energy, Power Ledger), but have been limited in terms of commercial traction. The case remains to be decided if existing players can be relevant, if such a market can exist and how these secondary markets will be able to interact with primary energy markets. Innovators with leading market pilots include Electron, Opus One Solutions and Trende. They are worth keeping an eye on!