Green Ammonia – Potential as an Energy Carrier and Beyond

The world is categorically dependent on ammonia. Today, half the world’s food production depends on it for increasing crop yield, resulting in a $70 billion market. However, outside of its traditional case, renewable-decentralized production of the molecule opens up broader set of use cases. Ammonia has nine times the energy density of Li-ion batteries, and three times that of compressed hydrogen, creating potential as a carbon-free energy carrier. Whilst Ammonia has a well-established supply chain, the “Green Ammonia” market is only just starting to gain traction globally.

Greening molecules

Energy carrying molecules have for centuries served as the productive means of low-cost energy transfer. Today, increasing demand to replace carbon intensive energy is creating opportunity for molecules such as hydrogen, methanol and ammonia as replacements for CO2 alternatives.

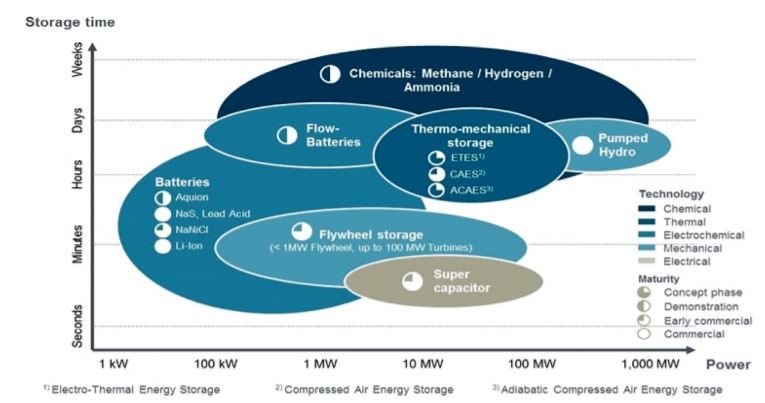

Coupling renewable electricity production to ammonia, creates the opportunities for a competitive market against electrochemical batteries, pumped hydro and capacitors to balance consumption and renewable generation. What differentiates ammonia and other chemicals is ability to hold energy for a long period of time, which can be transported long distances at lower cost (see figure below).

Why is ammonia being seriously considered as a green fuel?

Responsible for 1% of global emissions, the Ammonia market accounts for 17% of all chemical and petrochemicals energy. It is produced using natural gas which is reacted with nitrogen to form liquid ammonia through a process called the Haber-Bosch process. This dependency on natural gas is causing concerns for the fertilizer market.

As a carbon-free asset, green ammonia has several potential applications, including:

- Long duration renewable storage

- As a transport fuel for fuel cells vehicles

- As a feedstock as green fertilizer (production at point of consumption)

- As an industrial energy source.

Additionally, one of the strong arguments in favor of ammonia as an alternative fuel is that the production and distribution infrastructure is already mature at the relevant scale.

Interested in the future of hydrogen and its potential to reduce our dependence on fossil fuels? Join us on 21-22 July for Cleantech Interactive. The theme of our third edition is Hydrogen Innovation and Global Decarbonization.

Viable routes for green production

1. Existing process: Using a Large-scale centralized Haber-Bosch synthesis utilizing steam methane reforming across (SMR-HB).

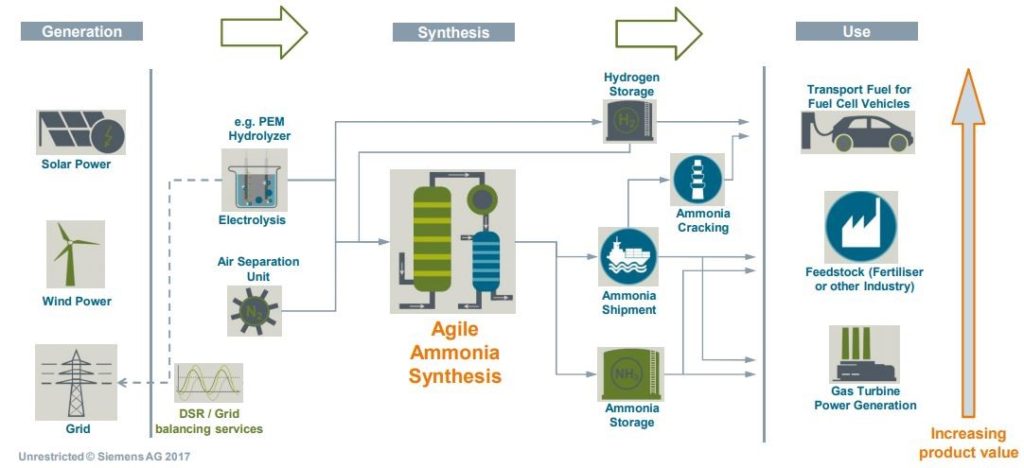

2. Medium-term: All electric distributed Haber-Bosch process at smaller scale, utilizing electrolysis and a nitrogen air separation stage (As shown above in figure 2) (E-HB).

No major ammonia plant uses this method today, because SMR-HB became cheaper, but some projects have used E-HB profitably using hydroelectric dams at large scale. The key challenge today is how to replicate the method cost efficiently at smaller scale.

In the 1920s, Norsk Hydro scaled the tech using hydroelectric dams until the end of the twentieth century. The company later split into Yara, now the biggest ammonia producer in the world, and Nel, which makes electrolyzers. Recently Yara has been aiming to decarbonize its existing assets by gradually increasing the proportion of renewable feedstock, reducing fossil fuel consumption. This February the company partnered with Engie for a $200 million project to convert one of their Australian ammonia plants from natural gas to renewable power, using PEM electrolysis.

PEM electrolysis is gaining popularity to the system flexibility suiting the demand of renewable power. Starfire Energy has developed a novel solution producing ammonia using a process which is adapted for variable power operation. Other electrolysis solutions are being looked at. Technology developer corporate Haldor Topsoe is looking at high temperature electrolysis which are an attractive option ability to separate oxygen from air and incorporate waste heat to save power, resulting in lower investment and higher efficiencies. In March 2019. the company announced a demonstration project in the Netherlands.

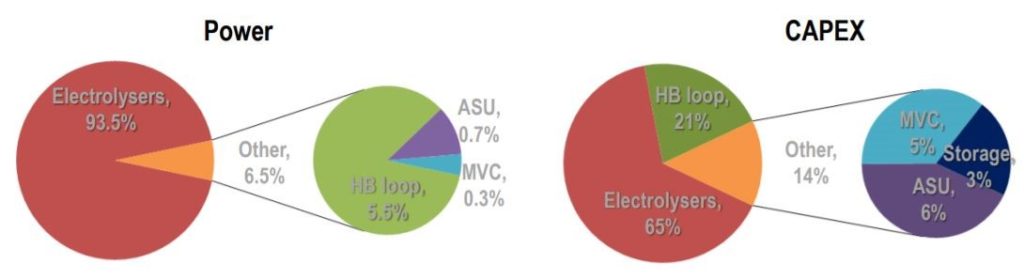

Today the cost of green ammonia remains significantly higher than SMR-HB. To reach cost parity, renewable energy prices need to drop, electrolysis cost needs to come down, electrolysis efficiency needs to go up and the Haber-Bosch loop needs further optimization for smaller scale. (See figure below.) Additionally, the ammonia-to-hydrogen step, whilst offering optionality for customers, has a significant impact on energy and costs.

3. Long-term: Distributed direct ammonia production

Single step production is at a much earlier stage of development. Some solutions look to remove or adapt the Haber-Bosch process as a way to reduce capital. Solutions directly producing ammonia from water and nitrogen include electrochemical synthesis, photochemical synthesis or chemical looping. Significant technical challenges which require significant time and R&D investment., however.

One of the few companies looking to commercialize the technology is Iceland-based Atmonia, founded in 2016. Atmonia is commercializing an electrocatalytic process for generating aqueous ammonia directly from air and water. Their novel catalyst functions at ambient temperature and pressure, meaning is can be scaled to the flexible needs of renewable electricity and can at smaller scale, potentially running on-farm or in a more distributed network of production. The company has raised $4.5 million in grants so far and is closing its seed round of $2 million to build a prototype plant. The challenge for the technology will be if it can be scaled effectively.

Key applications in the market

Maritime transport fuel: Driven by emissions reduction targets set by the International Maritime Organization, ammonia is being considered as an alternative to bunker fuel. Widespread commercial adoption is predicted by DNV GL to begin in 2037. Ammonia is estimated to represent ~25% of the maritime fuel mix by 2050. Mechanical engineering giant MAN is planning to develop an ammonia-fueled two-stroke engine for the marine market and is in talks to Siemens about supplying green ammonia.

Industrial Energy Source: The generation of heat for industrial processes accounts for 10% of global greenhouse gas emission. Similar to hydrogen, ammonia is being considered for its potential to directly power combustion without any CO2 emissions. Siemens has built a Green Ammonia energy storage demonstration in the UK to evaluate an all-electric synthesis and energy storage demonstration system based on Green Ammonia.

The bigger picture – ammonia real opportunity for renewable energy export

“The Green Ammonia Consortium in Japan estimates that demand for direct use of green ammonia will reach 1.7 mtapa by 2030.”

The hydrogen market has undergone considerable growth in the past 18 months. Multiple countries now see the molecule as a key part of their energy mix. Many countries are looking to import this hydrogen despite having a deficit of renewable energy or natural gas to produce hydrogen (Korea, Japan, Singapore). This is creating opportunity for countries such as Australia which have been favored with high deposits of clean energy. They see potential to create a new export market, building on the established natural gas a coal export market. With a higher energy density, ammonia is seen as a ideal solutions to low-cost, high value energy transfer cross-boarder. The Opportunities for Australia from Hydrogen Exports, calculated global demand for hydrogen exported from Australia could be over three million tons each year by 2040, which could be worth up to $10 billion each year to the economy by that time.

Green Ammonia has a much broader opportunity here to attract buyers in places such as the European Union and California, which have created incentives to buy greener fuels. Once mainly considered fertilizer feedstock, ammonia has potential to become the first renewable energy export market.