Greening Critical Metals – Mining and Recycling

Mining can be an environmental and social disaster – causing 4-7% of all global GHG emissions (scope 1 and 2), pollution, water stress, deforestation, political unrest – the list goes on. This is why, historically, investors and innovators alike have steered clear. However, the technology required to build a low carbon economy requires the spoils of mining from lithium to build many things, from electric vehicles to steel for wind turbines.

This positions mining in the odd position of being both the cause and the solution for climate change.

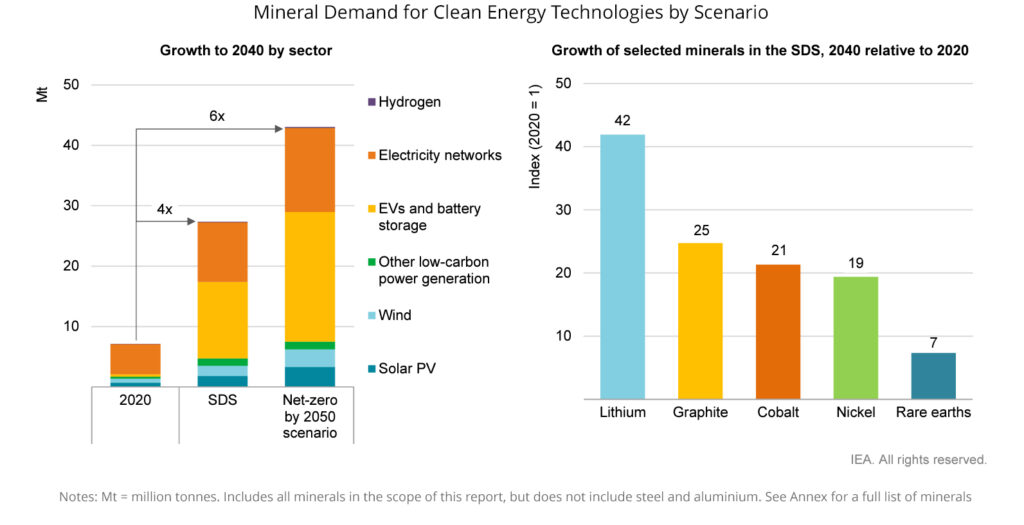

Critical metals (lithium, cobalt, nickel, etc.) are essential for emerging technologies and have limited availability, making their responsible extraction and sustainable supply chain management crucial (Figure 1). The primary applications and interest in cleantech ecosystems are for battery materials.

Figure 1: Predicted Growth of Selected Minerals in the Sustainable Development Scenario (SDS), 2040 Relative to 2020

Demand is Driving Innovation in the West

To build a low carbon economy and electrify the global energy system, the average amount of critical materials needed for a new unit of power generation capacity will increase by 50% by 2040, and up to 70% for electric vehicles (EVs). Automotive lithium-ion battery demand increased by about 65% to 550 GWh in 2022, from about 330 GWh in 2021. The rise in demand was mostly due to growth in EV car sales. In 2022, new registrations for EVs rose by 55%, compared to 2021.

Lithium: Projected to experience the fastest growth driven by EV and battery storage demand. Spot price is $60,000/t (June 2022).

Nickel: Demand from stainless steel, hydrogen electrolysers, EVs and batteries. Spot price is $31,000/t (June 2022).

Cobalt: Critical for the thermal stability of lithium-ion batteries. Demand estimates depend on battery chemistry evolution — some producers are substituting nickel. Spot price is $87,000/t (June 2022).

Copper: Electricity network expansion and wind turbines are significant drivers for growing demand. Spot price is $7,500/t (June 2022).

Mining Industry Challenges

The mining industry has been conservative and has had risk adverse attitudes toward innovation, largely attributed to the capital-intensive processes required for mining operations. Permitting can take 2-5 years, leading to a culture of information withholding to maintain competitive advantage. Despite rising demand, there has been a drop in investment in mining sectors due to capital expense increases, shareholder resistance, and ESG risks.

Supply Chain Dynamics

The biggest demand pull for low-carbon technologies is currently in western countries, which is predicted to increase. For example, The U.S. Inflation Reduction Act will provide billions of dollars in tax incentives for renewable energy with commitments to increase the domestic supply of critical minerals.

At present, critical metal production and refining is concentrated in a few countries, e.g., Russia supplies roughly one fifth of the world’s high-grade nickel, while China processes over 50% of all lithium. Many western countries that are starting to reclaim critical mineral supply chains, however, are constrained by more stringent environmental and social regulations and higher Op-Ex.

More efficient and sustainable mining and refining technologies can enable localized production in locations with stricter environmental standards and social licenses, while recycling creates an alternative source of supply.

Investment Landscape

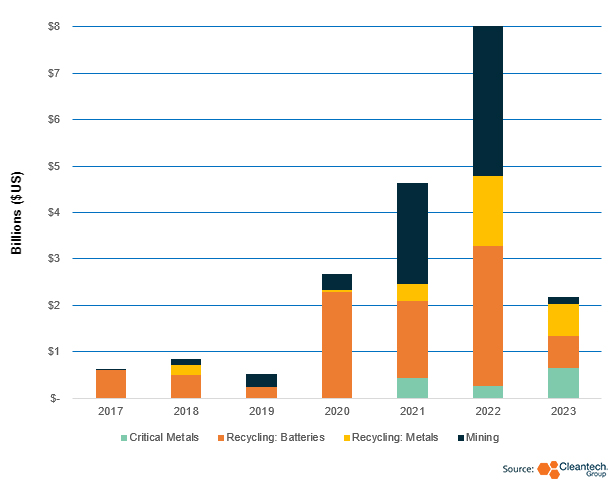

There is an upward investment trend in critical metals sectors, mining, and recycling technologies (Figure 2). The most significant investment sector is for new battery recycling technologies in North America, supported by VCs, strategic automotive and recycling investors, as well as government grants and loans.

- August 2022: Mercedes-Benz announced their intention to sign a deal with Canadian lithium hydroxide producer, Rock Tech Lithium, for up to 10,000 tonnes per year.

- February 2023: Cyclic Materials, provider of a circular supply chain service platform facilitating the recycling of critical metals, received $3.6M from Sustainable Development Technology Canada (SDTC) to support the recovery of rare earth metals projects.

There has been a yearly 2-fold increase in mining investment, a trend which is continuing in 2023. Mining investments are high risk but high reward. Success stories in improved ESG and efficiencies, as well as changing incumbent attitudes towards innovation, and high predicted material demand are encouraging new investors for larger amounts.

- January 2023: Summit Nanotech, producer of lithium brine water using advanced nanomaterials, raised $50M in Series A funding to scale the resource base in Canada.

- September 2022: Ideon Technologies, developer of sensors and software to provide 3D visualization and analysis of underground sites, enabling precision mining, reducing drilling costs, time, and environmental impact, raised $16M in a Series A round.

However, due to slow ROI’s (5-15 years) and the large-scale and slow development of mining projects, many technology types are incompatible with the VC model – many investors we spoke with remain apprehensive, particularly with hardware.

Figure 2: Total Global Investment in Cleantech Innovators in the Critical Materials Sectors

What to Watch

With current high projections for critical materials demand, mining for critical metals will need to be upscaled, but it isn’t moving at a pace to keep up with demand. Technology will play a crucial role in ensuring this scale-up is done as sustainably as possible. However, there is the real risk that environmental gains from low carbon technologies could be negated if mining is scaled-up with its current impact.

I would be interested to see the upstream impact of supply chain monitoring and traceability technologies, like Circulor’s partnership with RECHARGE (European industry association), for lithium batteries to develop a more sustainable, innovative, and competitive value chain. With data on mining and end-of-life inefficiencies, battery developers may be able to charge a premium for more sustainably produced batteries and, therefore, create a higher demand for sustainable production.

I would also be curious to see any examples of oil and gas assets being repurposed for critical metals mining, to showcase the potential for recycling and upskilling in oil and gas, as well as to become a shining example of hope for the low-carbon economy.