How Crop Robotics Can Make Our Food System More Sustainable

In all but the poorest countries on Earth, the number of people working in agriculture is trending downward. This has implications not just for food security, but also the impact that food production has on the environment.

With more and more mouths to feed – but fewer laborers to employ – farmers must rely on other means to try to boost productivity:

- By expanding their use of heavy machinery and intensive land management practices which lead to soil erosion and carbon emissions; or

- Via increased reliance on chemical fertilizers and pesticides that can pollute the environment and harm biodiversity when over-applied.

At the same time, inflation and geopolitics are making many of these chemical inputs prohibitively expensive – leaving farmers and consumers even further out of pocket.

Some innovators see robots offering a solution to these combined challenges of less labor, higher costs, and climate change.

How can robots help?

- As much as 34% of produce is wasted before it even leaves the field, with farmers leaving crops unharvested due to labor problems (Santa Clara University). Robotic solutions could meet this shortfall and reduce food loss and waste, which are a major contributor to greenhouse gas emissions.

- Reduce overapplication and runoff of agrochemicals thanks to precision technologies such as computer vision and AI modelling that can apply inputs more efficiently – e.g., by identifying and targeting individual weeds among crops.

- Since water is used to dilute agrochemical tank mixes, these precision technologies can also reduce water usage at the same time.

- Reduce soil erosion through optimized application of inputs and removal of human laborers and heavy machinery.

- Enhance productivity thanks to optimized crop cultivation, reduction in wastage / loss due to damaged or unharvested produce, reduced labor costs, and round-the-clock operations (e.g., night-time spraying and harvesting).

Different Robots for Different Needs

Innovators are developing both fully autonomous and semi-autonomous robotic equipment to tackle the whole spectrum of on-farm tasks at various points through the growing cycle – from scouting and land preparation through to planting, crop management including spraying and weeding, and harvesting.

Robotics start-ups tend to focus (initially, at least) on one of four cropping formats which each have different requirements for these tasks:

- Row crops (e.g., wheat, maize) — Innovator example: Naïo Technologies

- Specialty field crops (e.g., potatoes, berries) — Innovator example: Fieldwork Robotics

- Orchard / vineyard (tree fruits, vine fruits) — Innovator example: Tevel

- Indoor farming, including greenhouses and vertical farms – Innovator example: Traptic (see below)

Many start-ups have gravitated towards specialty crops, fruits, and vines, since these types of produce tend to be sold at higher price points – meaning there is greater motivation to reduce waste, increase efficiency, and maximize margins.

Key areas of technological research and innovation in crop robotics include:

- Computer vision-enabled via cameras and sensors for data collection and smart recognition of specific plants and other items

- Machine learning for mapping, modelling, and decision-making based on collected data

- Self-driving technologies

- Robot arms with grasping capabilities

Adoption and Business Model Challenges

While robotics hold promise for the agricultural sector, innovators face a number of hurdles before they can actually set their solutions to work in the field.

Surveys suggest that farmers are open to automation, but they often view adoption of novel technologies as high-risk, particularly when it isn’t clear what, if any, ongoing support will be provided to them. As already noted, farmers are facing huge pressures to deliver enough produce, on time and without costs spiraling. It isn’t difficult to see why some may have misgivings when it comes to experimenting with robots.

Then there’s the issue of cost: generally speaking, robots don’t come cheap.

Semi-autonomous solutions – such as smart sprayers that can be hooked onto tractors — are more likely to be at a price point where farmers might consider a one-off purchase. For far more complex, fully autonomous robots, however, service-based models may be more suitable; some start-ups are beginning to build agronomy advisory offerings on top of their device businesses using the data they have collected in the field.

In any case, it’s often tough for small robotics start-ups to develop relationships with farmers that will allow them to validate their tech and business models at scale.

As such, partnerships with ag retailers, inputs providers, co-ops, and the like may present the best channel for start-ups to get their robots into farmers’ fields.

Farm machinery corporates are also becoming more involved in the robotics space, and may prove attractive partners, too, given they already have the relationships to farmers and other stakeholders in place. Prime examples here include CNH Industrial and John Deere, which have each developed their own autonomous tech and have acquired ag robotics start-ups (see below).

Trends in Investment Activity

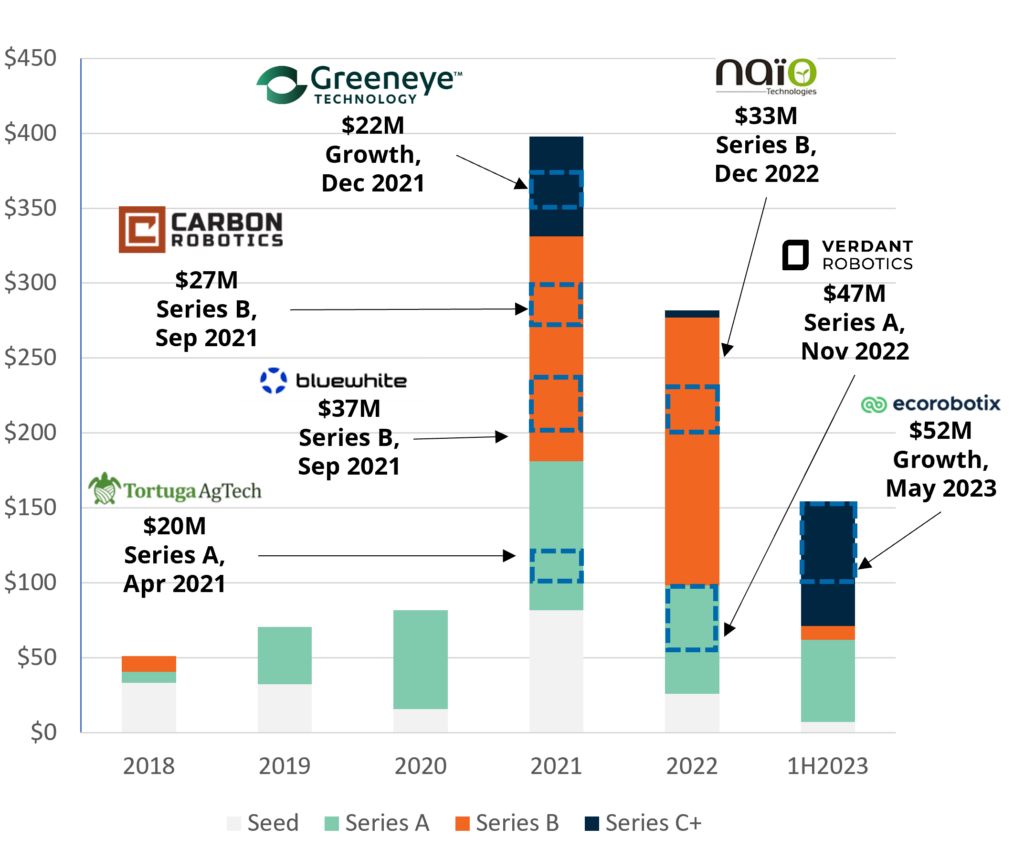

Figure 1. VC Funding to Farm Robotics ($M) With Key Deals

Overall funding to farm robotics start-ups is slowing (see Figure 1), though there has been a pick-up in later-stage deals and M&A activity that suggests the sector is maturing.

- Buyers of crop robotics start-ups appear to be mainly driven by a need to obtain specific technological capabilities, e.g., Bowery bought Traptic, an open-field fruit harvesting robot, for its computer vision tech to repurpose it for indoor precision picking.

- Buyers fit a variety of profiles, e.g.:

- Traptic > Bowery (vertical farming)

- Root.AI > AppHarvest (tech-enabled greenhouses)

- Blue River, Bear Flag > John Deere (ag equipment major)

- Traptic > Bowery (vertical farming)

- Failed ag robotics start-ups with strong IP may still generate value:

- Wavemaker Labs bought Abundant Robotics‘ patents and trademarks and relaunched the company

- Raven Industries bought patents of Jaybridge Robotics

- John Deere acquired IP and tech assets of Light (depth sensing and camera-based perception)

- Wavemaker Labs bought Abundant Robotics‘ patents and trademarks and relaunched the company

Looking Ahead

Funding will increasingly flow towards robotics ‘platforms’ that can handle a multitude of on-farm tasks, rather than those focused on a single application. As robotics innovators grow their datasets and analytics capabilities through in-field activity, some will decide to offer ongoing agronomic and other advisory services as part of their business model in order to secure recurring revenue.