Hydrogen in China

During the summer, China’s Science and Technology Minister, Wan Gang, called for China to “look into establishing a hydrogen society.” Given the Minister made a similar call two decades ago on vehicle electrification, which played a role in China’s current market dominance, close attention is being payed.

China is aggressively driving hydrogen and fuel cell development, and is on track to outpace development in the EU and U.S. with a focus on hydrogen busses and trucks. In the first seven months of 2019, installed capacity of hydrogen fuel cells has increased six-fold.

While some major oil and gas corporates are waiting on the side lines for more sure signs of government support, early-stage local and external innovators have mobilized across the country.

To the Chinese government, hydrogen offers way towards meeting climate and pollution goals without increasing reliance on imported fuels. It also opens a new avenue for developing clean technology manufactured goods for export. The country hopes that hydrogen will account for 10% of the Chinese energy system by 2040.

Looking for additional insight? Ready for a dynamic setting where you can build a global network? Join us for the 20-21 July edition of Cleantech Interactive. Our theme is Hydrogen Innovation and Global Decabonization.

China’s existing relationship with hydrogen

Hydrogen isn’t a new thing for China. It is the world’s largest hydrogen producer by a long way, producing 22 million tons of hydrogen per year, one-third of the world’s total product. Production is mostly in dedicated oil- or coal-based plants in refineries or chemical facilities, of which production from coal remains cheaper than natural gas or water electrolysis at around 0.8 Yuan ($0.11) per cub meter.

Hydrogen supply comes from a high local demand for chemical production and oil refining. Its established use as a feedstock comes from its dominance of the ammonia market (which accounts for 2/3 of global hydrogen demand), accounting for 40% of global annual production of global annual production volume.

China’s evolving approach

While China’s outlook for hydrogen will see growth in traditional feedstock segments, the projected 60-million-ton demand (by 2050) is thought to come from its broader role in the Chinese energy network. As an energy vector, Hydrogen is expected to have applications across sectors including transportation, alternative feedstocks, building heat and power and industrial energy, with a key focus of carbon neutrality and energy independence.

Since President Xi Jinping call for “four revolutions” for energy in 2014, China has seen a turn towards energy development, directed at establishing a clean, low-carbon, safe and efficient energy system.

In 2015, the Chinese government published the Made in China 2025 initiative – a ten-year plan to upgrade China’s manufacturing industry, including hydrogen as a key technology to develop in the energy vehicle market.

The first Hydrogen Fuel Cell Vehicle Technology Roadmap was released in 2016, and later that year H2 new energy vehicles & hydrogen infrastructure were added to the 14th Five-Year Plan outlining targets for mass application of hydrogen in the transport sector (shown below).

This year China revamped the Made in China 2020 policy strategy. Among smaller updates, the big change was the movement of the New Energy Vehicles Subsidy. At the end of the year, the subsidy for pure battery electric cars will be cut and moved to hydrogen fuel-cell vehicles. The funding’s saved from EVs will be spent on hydrogen charging infrastructure and services, which are identified as the bottlenecks for industry progress. The aim is to achieve mass production of FCEVs by 2020. Based on the success story of PHEVs and BEVs in China, it is likely that the ambitious targets will be reached.

Industrial clusters:

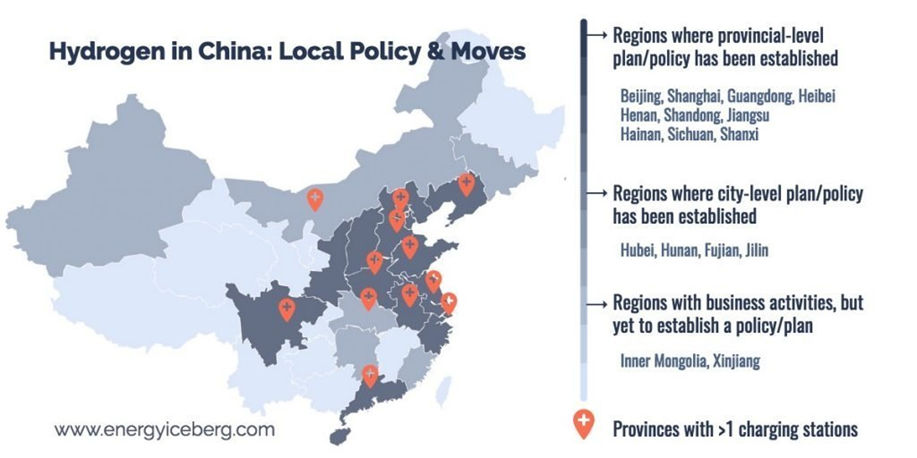

Following the national policy changes, local authorities have actively rolled out plans to boost the sector. Over 11 provinces have announced local subsidy schemes to provide additional support to hydrogen fuel cell vehicles. Most notably has been announcements of hydrogen clusters; areas of highly concentrated industrial activity where the capital cost of hydrogen infrastructure can be shared across market participants. To date, 20 cities have announced plans to develop hydrogen clusters. Chengdu, Datong, and Wuhan, three capital cities of Sichuan, Shanxi and Hubei provinces, respectively, are forging hydrogen capitals. Some of the key clusters announced are:

- Beijing-Tianjin Hebei between Beijing and Zhangjiakou: Plans includes 3,000 FC Vehicles by 2021, a ‘hydrogen corridor to Beijing, cogeneration for communities, backup power and blending in hydrogen into existing natural gas infrastructure

- Yangtze River delta across Shanghai Jiangsu Province: Plans for more than 20 hydrogen expressways before 2020 and more than 500 hydrogen refueling stations connecting all cities in the region, Pearl River delta across Foshan-Yunfu\Dongguan and Guangdong

Despite ambitious targets, most of the cities have a long way to go to hit the targets. Shanghai, for example, currently has 6 FC buses, 50 FC cars, 28 FC postal trucks, 20 FC shuttle mini-buses and 500 FC logistics vehicles running on the streets. Beijing currently only has 5 FC buses, 30 FC shuttle mini-buses and 5 FC logistic vehicles will be put into use within in 2018.

Localized dynamics – Changing business models and innovation

Given the gap between targets and today’s reality, opportunities exist for both domestic and non-domestic corporates to invest in and capitalize on a range of innovation across the hydrogen value chain.

Today, most of China’s hydrogen comes from coal. China has nearly 1,000 coal gasifiers in operation, accounting for 5% of China’s total coal consumption. Most of the demand is in the Yangtze River Delta and Pearl River Delta. China also makes use of steam methane reforming, capitalizing on China’s natural gas infrastructure. The success for natural-gas solutions may be challenging however, given that coal gasification in China is about 20% cheaper than hydrogen from natural gas production.

China is a global leader in installed renewable capacity. Decentralized hydrogen generation, coupled with decentralized renewable generation is gaining interest as a route to deal with renewable variability and curtailment, due to the countries geographical generation split in the north-west and load consumption in the eastern coastal provinces. PEM Electrolysis is being looked at as the solution, given its ability to deal with the intermittent decentralized renewables. Additionally, renewable energy storage in the form of hydrogen has potential due to its high energy density, long-term storability and ability to transfer the electricity into other energy sectors. The IEA disclosed four large-scale PEM projects in China in February, with players such as Guangdong Synergy Hydrogen Power Technology Co, an organization focused on mobility applications.

The future of electrolysis

For China, the cost of hydrogen production from coal remains very low. The Wuhan Economic and Information Commission disclosed that after pressurization and storage, production costs for hydrogen remains three times less than hydrogen production via water electrolysis. Given this cost gap, the lingering question for China will be whether electrolyzer cost projects can decrease enough to warrant a global transition from coal-based hydrogen production to electrolysis hydrogen production.

The immaturity of the Chinese PEM market also increases costs. A significant technology gap exists between domestic and international manufacturers. China’s PEM electrolyzer market leaders China Shipbuilding Industry Corporation and Shandong Saikesaisi Hydrogen Energy Co currently struggle to compete with international market leaders such as Hydrogenics (which was acquired by Cummins this summer), Siemens, ITM Power and NEL Hydrogen. These corporates are working on plans to localize their production lines. Siemens, for example, started developing its Chinese market strategy at the end of last year. Earlier this month, Siemens and China State Power Investment Corp. signed a new MoU for the development and utilization of green hydrogen.

Coal-based generation – A means to an end?

At present, multiple projects are planned for coal-based production. Although relying on coal may not aid the countries emissions targets’ in the short term. Many think that utilizing carbon capture technologies, combined with coal gasification, may provide a key stepping stone for the hydrogen market to develop. Given that a new hydrogen market would then be established, sustainable production methods can be fed in later stage once the cost for production is lower.

Driving for innovation

Automotive startups are at the early stages in realizing the opportunities. Bloomberg reported that the fuel-cell vehicle industry has received more than $1 billion worth of investments from Chinese companies.

Wuhan HydraV Fuel Cell Technologies’ first fuel cell engine entered production in Datong City. The company is planning a $380 million hydrogen energy industrial park, with an annual production capacity of at 50,000 hydrogen fuel cell engines. Beijing Shouhang IHW Resources Saving Technology has also set up a branch in Datong, with plans to build three hydrogen production factories, 10 to 20 refueling stations, and three to five distributed hydrogen power plants. Multiple projects like this are underway across the country, and most are looking to coal instead of electrolysis to meet targets. Datong currently has annual coal output of over 100 million tons, thus producing hydrogen from coal is a key step for the city to move towards becoming a hydrogen capital.

Founded this year, Grove Hydrogen Automotive is an all-hydrogen automobile startup developing three hydrogen-based vehicles designed for mobility-as-a-service fleets. With backing from CICC Capital, Everbright and Wuhan Donghu Guolong, the company is developing a 3.5 meter sharing car, a delivery van and a taxi vehicle. The start-up is seeing opportunities for a service-based, point-to-point business model, given that giants such as Alibaba have moved away from owning delivery service and are now tendering for private package deliveries. A hydrogen-based fleet allows for extended range vehicles with rapid charging times compared to existing electric vehicles.

Founded this year, Grove Hydrogen Automotive is an all-hydrogen automobile startup developing three hydrogen-based vehicles designed for mobility-as-a-service fleets. With backing from CICC Capital, Everbright and Wuhan Donghu Guolong, the company is developing a 3.5 meter sharing car, a delivery van and a taxi vehicle. The start-up is seeing opportunities for a service-based, point-to-point business model, given that giants such as Alibaba have moved away from owning delivery service and are now tendering for private package deliveries. A hydrogen-based fleet allows for extended range vehicles with rapid charging times compared to existing electric vehicles.

A lot of money is moving around in this space:

- Great Wall Motor has invested over one billion Yuan ($149 million) in research and development in hydrogen energy and fuel cell vehicles.

- China National Heavy Duty Truck Group Co Ltd is planning to spend over $7 billion to manufacturer fuel-cell vehicles in Shandong

- The start-up Mingtan Hydrogen, is planning to invest $373 million for a hydrogen industrial market. It wants to make a 100,000 fuel cell stack by 2022, and is looking to raise $14 million to expand its production capacity.

While the outlook appears promising for the future of hydrogen in China, a range of hurdles still exist. Issues surrounding hydrogen safety standards on the exclusion zones and around transporting pressured hydrogen still need to be overcome. Given the evident ambition from the private sector, the market will most likely find intelligent solutions to work round these hurdles in the short term, capitalizing on the preexisting infrastructure.

Keep an eye on

- The emergence of a new market for ammonia as an energy carrier, with countries such as Australia looking at its export potential, due to its higher energy density.

- Biomass gasification and Microbial Conversion technologies with start-ups like Electro-Active Technologies looking to create hydrogen from waste food. Given the huge volumes of waste in China there is a large untapped market here.