Nuclear Fusion: The Race to Gain

Fusion companies have made significant strides in early 2022 after raising a landmark $2.8 billion in 2021. In these first few months, Joint European Torus (JET) broke the 24-year-old fusion record – generating the highest sustained fusion energy pulse ever; First Light Fusion demonstrated fusion; and HB11 Energy demonstrated fusion of hydrogen and boron-11 using high-power lasers- producing 10x more fusion than expected. Additionally, there has been an influx of capital to support addressing critical engineering challenges, with First Light Fusion, Marvel Fusion, and Kyoto Fusioneering all raising significant funding rounds in February alone.

Fusion can provide a highly necessary, abundant and zero-carbon baseload energy source with no risk of nuclear accident or long-lived radioactive waste. ITER, the tokamak fusion project supported by 35 nations, points out that a fusion reaction releases four million times more energy than the burning of coal, oil, or gas. Fusion technology is new and expensive, and therefore requires large amounts of capital to de-risk its technology and accelerate the path towards commercialization. While recent government support – like that of the $50 million provided from the U.S. DOE under instruction of the Biden-Harris Administration’s plan for commercial fusion energy – shines a light on the need to accelerate development of fusion technology, government funding pales in comparison to the billions of dollars in capital companies are raising through private investors. The White House planning of the public-private partnership in fusion and additional government support could be crucial in aiding fusion demonstration and pilot projects to prove its potential as a source of baseload energy.

Although not all in the fusion community agree on who will reach the positive net energy gain threshold or commercial status first, all do agree that fusion is no longer a 20-year waiting game, in large part due to the impact of computing power to support advanced modeling. Each company has different paths and challenges getting to fusion, gain, and commercial stages.

Science & Engineering

California-based TAE Technologies is developing an advanced beam-driven field-reversed configuration reactor with the goal of using a hydrogen-boron fuel cycle. TAE’s current fusion platform, Norman, has successfully been used for higher temperature experiments, and its successor, Copernicus, will be used to continue these experiments. TAE’s seventh-generation platform, Da Vinci, aims to both demonstrate fusion and net energy gain. Da Vinci is expected to be online sometime in 2027 or 2028 and will address engineering challenges related to using hydrogen-boron-11 fuel. TAE’s founder, Harry Hamlin, believes their key advantage is the use of hydrogen-boron fuel, as it allows for an aneutronic fusion reaction.

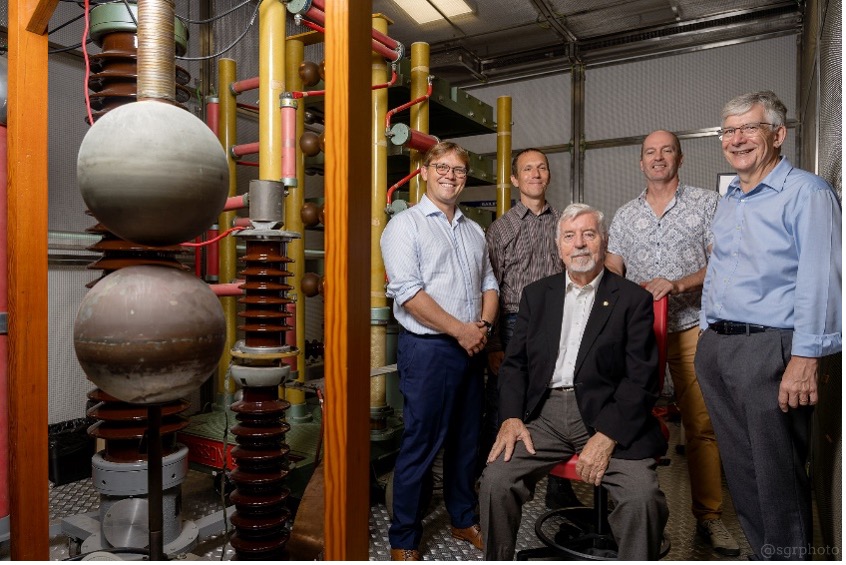

HB11 Energy is similarly using hydrogen-boron-11 fuel, but with a laser-ignited, non-thermal start reaction. As previously mentioned, the company demonstrated a non-thermal fusion reaction earlier this year and produced 10x more fusion than anticipated, representing a remarkably high gain of 0.05%. HB11’s aim is to use their reaction to create electricity through the direct conversion of charged helium. Simulations and computing power that have greatly accelerated experimental findings for more established reactor designs like the tokamak are not yet mature for HB11’s technology. HB11 founder, Warren McKenzie, told Cleantech Group that the company is looking to raise funding this year to refine several target concepts being considered to maximize gain (Q). The development of these simulations will be instrumental to study the science behind their reactions and optimize a target design that can reach net-energy gain and beyond.

In contrast from TAE and HB11’s use of hydrogen-boron-11 fuel, First Light Fusion and General Fusion are both using deuterium-tritium (DT) fuel to power their reactions. While a hydrogen-boron reaction is aneutronic, a DT reaction produces neutrons and therefore requires a process to capture the energy from the neutrons to avoid damaging the reactor.

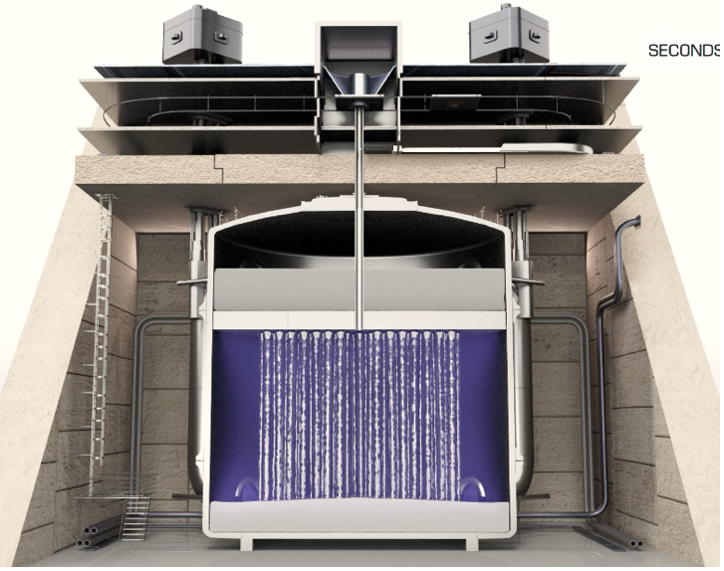

First Light Fusion is creating fusion by firing a projectile at a DT fuel pellet, causing a shockwave and cavity collapse that results in fusion. As previously stated, they have proven the fundamental physics of this principle, validated by the UK Atomic Energy Authority on April 6th, 2022. The approach enables a greatly simplified plant design, based on a molten lithium “waterfall”, which covers 99% of its reaction circumference, to deal with the issue of neutron embrittlement. Bart Markus, Chairman of First Light, believes that the key to the fast development of this technology has been “…the ability to simulate our reaction, it allows us to iterate the geometry and materials and run around 2,000 iterations in silico for each physical experiment.” First Light’s next step is gain, which will see them utilizing engineering to improve the precision of hitting its fuel target consistently. The company’s fusion timeline sees them at net gain in the mid to later 2020s, and because of its design Bart sees them on track to start building a commercial plant at that moment.

BC-based General Fusion is using a pulse process with a plasma injector and compression system to compress and heat the plasma to fusion conditions. The company achieves this compression with a collapsing liquid metal wall made of lead lithium. The liquid metal layer both acts as a shield to its reactor and slows down the neutrons produced in its DT-fueled reaction and absorbs their energy. In January, General Fusion announced they have demonstrated the engineering capabilities necessary to scale its compression prototype to a full power system. CEO Christofer Mowry says the company’s focus is on its commercialization strategy as it recently announced the building of its demonstration plant at 70% scale of a commercial plant. The demonstration plant will be built in the UK to draw on experience and supply chain talent from the Joint European Torus (JET) as it shuts down. General Fusion will use the plant as an opportunity to address engineering challenges related to connecting its two proven systems, the plasma injector and compression system, and expects to be online in 2026/2027.

Other Recent Market Activity

- December 2021: Commonwealth Fusion Systems, developer of a tokamak fusion reactor using Rare-Earth Barium Copper Oxide (REBCO) superconductor technology, raised $1.8 billion in a Series B round that will allow the company to construct, commission, and operate SPARC, a commercially relevant net energy fusion machine. The round was led by Tiger Global Management and saw participation from Bill Gates, Footprint Coalition, Google, Breakthrough Energy Ventures, and twenty others.

- November 2021: General Fusion closed a $130 million Series E round led by Temasek, with participation from new investors. The funding will be used for several near-term initiatives and milestones to progress the company’s goal of commercializing magnetized target fusion.

- November 2021: Helion Energy, developers of a field-reversed configuration reactor using deuterium and helium-3 fuel, raised $500 million in a Series E round led by Sam Altman, with participation from Mithril Capital Management, Capricorn Investment Group, and Dustin Moskovitz. The funding includes an additional $1.7 billion tied to Helion meeting key performance milestones.

- April 2021: TAE Technologies raised $280 million in its latest financing round as a result of achieving a scientific milestone on its path delivering energy from p-B11 fuel. The funding will be used in part to initiate development of Copernicus, which will provide TAE with opportunities to license its technology for use with DT fuel, while scaling to its goal of using p-B11.

Keep an eye on…

One major challenge innovator using tritium fuel have faced is tritium breeding. Companies like First Light Fusion and General Fusion are addressing this issue by bombarding their lithium with the reaction’s neutron byproduct to produce enough tritium fuel to sustain a power plant. Kyoto Fusioneering, a startup born out of Kyoto University, is not developing a fusion reactor, but rather designing and engineering technologies that will be crucial for the success of tokamak reactors. Kyoto intends to license its SCYLLA Advanced Self-Cooled Blanket to tokamak fusion companies to provide tritium self-sufficiency, allow for high temperature operation (~1000°C) and reduce neutron embrittlement. The company raised $11.7 million in a Series B round in February led by Coral Capital and received $7M in loan agreements from Kyoto Bank, Sumitomo, and MUFG Bank.