Predictive Maintenance Reduces Vehicle Downtime and Makes Connected Vehicles Safe

In recent years, predictive maintenance has become a hot topic across the industrial world. Companies like SparkCognition have raised hundreds of millions of dollars to predict machinery failures before they happen. The main goal is to anticipate defects and quickly repair components to prevent lost revenue and production from downtime. More recently, this same strategy is being applied to vehicles, from passenger cars to heavy-duty fleets.

The goals are the same:

- Reduce vehicle downtime

- Optimize vehicle health to extend the life of the asset.

However, the challenge is unique, as moving assets which are impacted by external variables such as driver behavior and weather are more complicated to maintain and predict than stationary industrial assets. As a result, predictive maintenance platforms in the mobility space have two main applications: fleet vehicle and connected passenger cars.

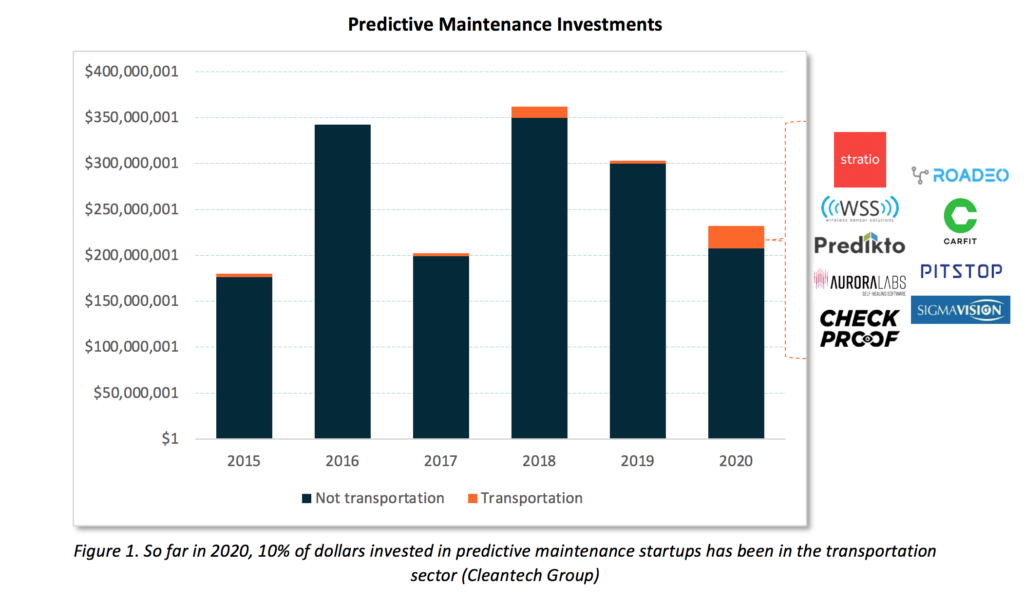

Predictive Maintenance Investments

Attractiveness

Despite advances in telematics systems and vehicle safety features, commercial vehicles are experiencing more on-road failures than ten years ago. Estimates of downtime costs for fleets range from $448-$760 a day. This primarily impacts fleets with high utilization rates, such as buses and trucks. As fleet sizes grow in scale and more vehicles are equipped with telematics systems, predictive maintenance will become easier to deploy. With the ability to tap into existing telematics systems, it will be critical to reduce vehicle downtime and maximize utilization. Across a large fleet, any reduction in maintenance time and costs can make a significant difference.

Today’s cars have been described as the ‘next big OS’, with infotainment and connectivity systems containing over 100 million lines of code. As with any code, this OS contains bugs which are hard to find manually and can lead to vehicle failures. Innovations to automate this process are improving the safety of connected vehicles by preventing critical failures. This will become increasingly important with autonomous vehicles. If a car is completely controlled by code and algorithms, any bug in the code can have serious safety implications.

Business Models

Companies operating in this space operate largely as SaaS platforms, using API keys to tap into existing telematics systems. The technology solutions provided by innovators in this space are focusing on maximizing the efficiency and speed of data analysis, actionable predictabilityand user experience.

Pitstop, a Toronto-based startup, has developed an automotive predictive maintenance platform which analyzes time-series data from telematics systems and test-based event data, then predicts component-level failures for batteries, engines or brakes. The company provides a proprietary telematics device (for an additional fee) which automatically connects drivers to maintenance shops once installed, streamlining the repair process. Pitstop recently raised a Series A round from Sensata Technologies, Ripple Ventures and Hike Ventures. This funding will be used to expand market reach, enhance product features and build additional prediction algorithms. Pitstop’s customers include Aisin, Fleet Complete, Smartcar and Continental AG.

Stratio Automotive, a provider of automated vehicle testing and automated vehicle maintenance that combines engineering and machine learning capabilities, raised a $3 million Seed round from Crane Venture Partners in 2019. Stratio’s customers are vehicle manufacturers as well as operators of heavy-duty vehicle fleets. The company’s goal is to reduce vehicle downtime to zero by continuously testing vehicles throughout their lifetime using automation to develop models for component performance.

Aurora Labs, a Tel Aviv-based developer of self-healing software for connected cars, recently raised a $23 million Series B round from Porsche, UL Ventures, Toyota Tsusho, LG Technology Ventures and Marius Nacht. Aurora’s self-healing software automatically detects and fixes bugs in a car’s code, as well as continuously rolling out new features. Aurora claims software-related recalls for safety and security will exceed 50% of all recalls by 2050, and their In-Vehicle Software Management enables all ECUs in vehicles to be updated automatically.

Competition

This is a fairly nascent space with plenty of room for new entrants. However, the complex nature of vehicle testing and diagnostics requires deep expertise in data science, vehicle performance and maintenance. Barriers to entry are high, but the opportunity is massive and current players are only scratching the surface of what is possible. End customers differ among market participants. While Stratio targets automotive OEMs and fleet operators, Pitstop targets fleet operators and maintenance shops, honing in on streamlining repair detection and implementation. Aurora Labs, on the other hand, focuses on OEMs, particularly in the passenger vehicle segment.

Keep an Eye on…

As connected car and autonomous driving technologies permeate the transportation sector, so will predictive maintenance capabilities. Although the latter is somewhat lagging, we can expect to see it increasingly adopted by automakers (particularly luxury cars and heavy-duty fleet vehicles), both in production processes and in-vehicle.

Ready For More Insights On Transportation and Logistics?