Q2 2023 in Cleantech Investments – A 2020s Status Quo is Starting to Emerge

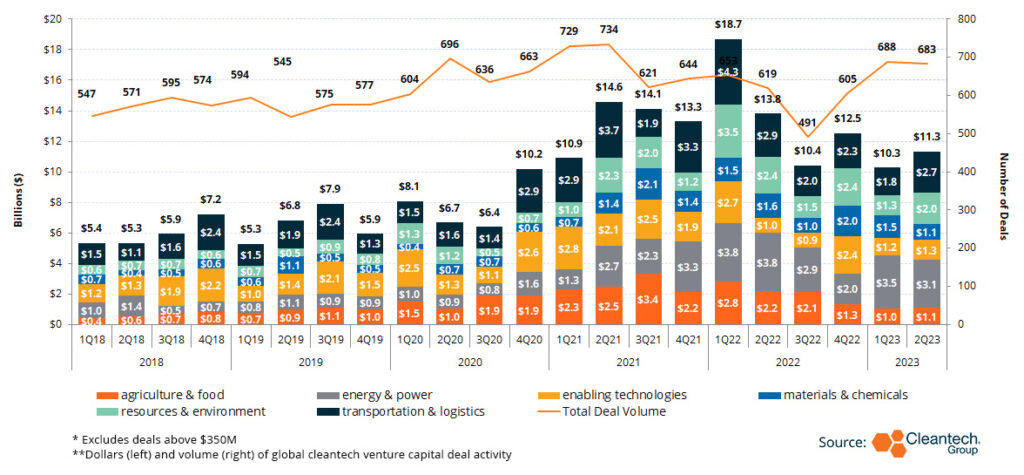

Cleantech Venture & Growth Investments by Industry Group (2018-H1 2023)

Since turning the corner out of the COVID-era investment explosion, we’ve frequently found ourselves in conversations around what type of “landing” can be expected in cleantech. Halfway through 2023 a picture is starting to crystalize – on this side of COVID, even with interest rates remaining high and dulling prospects for venture returns – we can still expect venture and growth investments in clean technologies to outpace those observed before 2021.

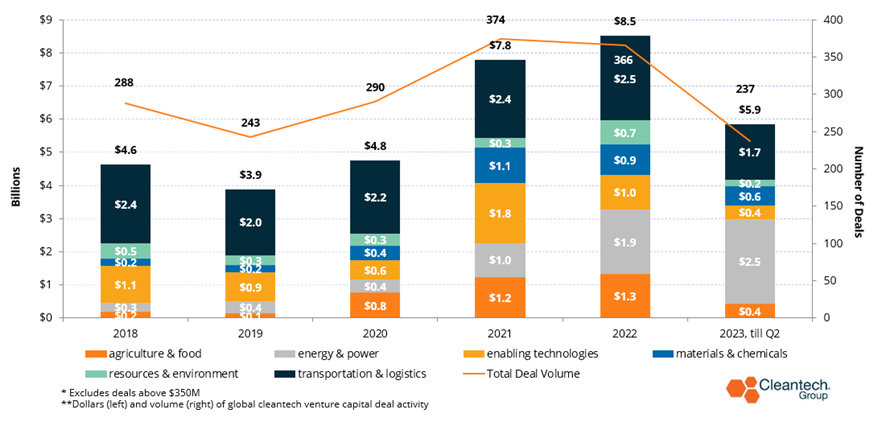

On a quarterly basis, energy investments in the first half of 2023 are stronger than they were even throughout most of 2021, signaling that the energy transition is occurring in earnest, and investors are confident in demand pull for new technologies. Regional trends are becoming clearer, too, with Asia-Pacific on track to have its biggest year ever since we began tracking the region, undergirded by a fast-maturing electric vehicle value chain and an appetite for risk in baseload power and long-duration energy storage investments.

Energy & Power investments in Q2 covered a wide surface area, encompassing high-CAPEX deep tech like long-duration energy storage and hydrogen electrolysis, while also seeing a big quarter in more rapidly-scalable technologies like energy networks and buildings optimization. We interpret this trend to mean that momentum toward the energy transition is now at a tipping point – the technologies needed to achieve energy use reduction (virtual power plants, buildings optimization) are now expanding at scale, while those needed for deeper decarbonization of the economy are now seeing innovation toward cost reduction versus 0-to-1 technological breakthroughs.

Companies working towards built environment decarbonization are continuing to lock up significant later-stage capital raises for faster deployment: German distributed solar PV aggregator 1Komma5 raised $468M this quarter, while U.S. smart home control panel manufacturer Span raised $96.5M and British smart building control platform Infogrid raised $90M. An area to watch for the rest of this year is the two-pronged trend of big funds raised to build out electrolyzer gigafactories (see Ohmium’s $250M raise to expand manufacturing capacity by 2 GW), and a growing appetite to experiment in next-generation electrolyzers, like Singapore-based Sungreen H2’s electrodes with a 30% less platinum group metals content.

A further testament to the acceleration of longshot energy technologies was another strong quarter by nuclear fusion companies. Importantly, these were not limited to North America and Europe, indicating a growing global landscape of future competitors. Significant deals in fusion included:

- China’s Neo Fusion, a company managed by a collective of state-owned enterprises, raised $142M in a growth equity round including from Chinese electric vehicle manufacturer, Nio

- Magnetic confinement reactor developer Energy Singularity (China) raised a $57.8M Series A

- Japanese magnetic confinement reactor company Kyoto Fusion raised $79M in growth equity

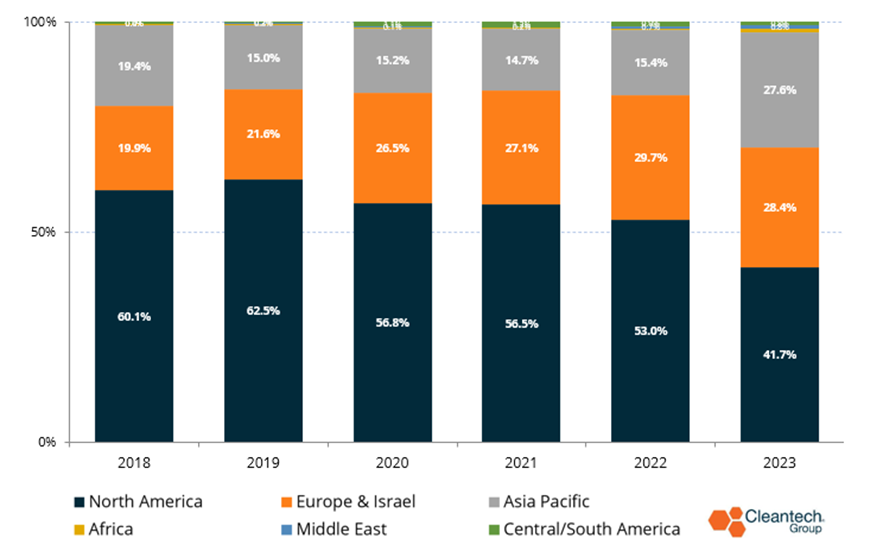

The strong Asia-Pacific showing in fusion is not an anomaly – we have noted throughout 2023 that venture and growth investments in APAC-based innovators are comprising a larger percentage of overall numbers than ever before.

Regional Share of Cleantech Venture & Growth Investments

This is not a function of any one technology success either – investments in APAC-based cleantech companies are on track to have their largest year since we began tracking them. APAC-based Transportation & Logistics companies are on track to have their best year ever, and Energy & Power innovators in APAC have already had their biggest investment year. Underpinning much of this growth is more innovation around long-duration energy storage (China-based RongKe Power and ZhongChu GuoNeng both raised over $140M this quarter) and an increasingly mature electric vehicle supply chain, from lithium-ion batteries and components to vehicles tailored to local markets.

Cleantech Venture & Growth Investments in APAC by Industry Group

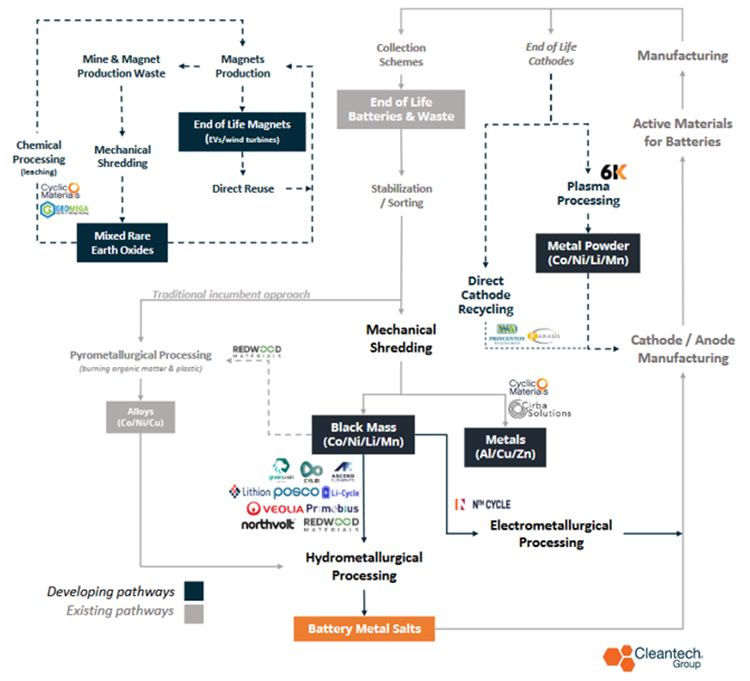

Many of the trends discussed throughout this quarterly recap have the theme of electrification running through them, by association that means that the technologies enabling more access to, and recycling of, critical materials will see a more forceful demand pull in coming months and years. The increase in hydrogen electrolyzers and fuel cells, too, will require more careful product engineering to remove critical materials bottlenecks. Across the first half of 2023, and especially this past quarter, we saw more movement across the critical materials value chain.

New Innovations in Critical Metals Recycling & Reuse

Technologies to close the enormous resource gap for electrification continue to attract investment. Technologies to enhance output from mining sites are now diversifying beyond just lithium to minerals like cobalt and copper and they are resolving issues from energy efficiency to water usage. AI solutions like Kobold Metals are supporting decision-making to ensure that unviable mines are never explored in the first place, and that environmental impacts are quantified before exploration.

Some notable deals in upstream critical materials sustainability this quarter:

- Kobold Metals raised $195M in a Series B round, with intentions to apply its technology and operations approach to a new site in Zambia

- Ceibo (Chile) raised $30M to continue development of a sustainable leaching process to access deeper reserves of copper ore

- Innovator in membranes, sorbents, and adsorbents for direct lithium extraction, EnergyX, secured a $50M round led by GM

- Gradiant is an innovator in desalination and zero liquid discharge technology for water treatment, which has multiple applications including in direct lithium extraction. Gradiant raised a $225M growth equity round at a valuation over $1B, making it one of the first water unicorns that we’ve tracked.

The midstream and downstream of critical materials sustainability continue to be an active space as well, as we saw technologies for advanced manufacturing of battery materials and battery recycling take in high levels of investment.

- Libode raised $375M in Series B, pre-IPO funding to manufacture cathode materials

- Forge Nano raised $50M in a growth equity round to develop a battery production line to satisfy full-scale, premium battery contracts using its proprietary atomic layer deposition technology

- 6K raised funds from Stellantis Ventures. 6K’s Unimelt plasma technology is used to produce sustainable critical materials including cathodes, and can also be used in battery recycling

- Nth Cycle, who has developed electro-extraction technology to support recovery of mine tailings, cathode materials, and critical materials from e-waste, raised a $20M round this quarter

As we’ve covered throughout this year, we see a number of spaces converging – most evident from this past quarter is that large-scale electrification is becoming a lower-risk proposition and will have a strong pull-through effect on technologies that support supply of materials into electrified fields — even stronger if hydrogen electrolysis is now set to be in the solution mix. It’s not just the end use markets that are becoming global either; competitors across the value chain are emerging around the world, and if the big year that Asia-Pacific is seeing is any indicator, competition is only going to heat up.