Residential Heat Pumps to Decarbonize CO2 Emissions

Residential heating and cooling accounts for approximately 10% of global greenhouse gas emissions while traditional gas heating systems also emit hazardous sulfur dioxide, nitrogen oxides into homes, and contribute to respiratory health issues, smog, and acid rain. By 2050, 2.6 billion people globally will live in regions requiring heating and cooling with 47% of the world relying on natural gas for heating. Expediting the transition from fossil fuels is key to limiting emissions. Heat pumps can aid in this transition while improving home heating efficiency exponentially.

In 2022, Russian natural gas prices ballooned to 270% of their pre-war price, leading to an explosion in demand for heat pumps in Europe. The now $8.1B global heat pump market is experiencing exceptional annual growth but has encountered significant manufacturing and installation challenges.

Heat Pump Innovations

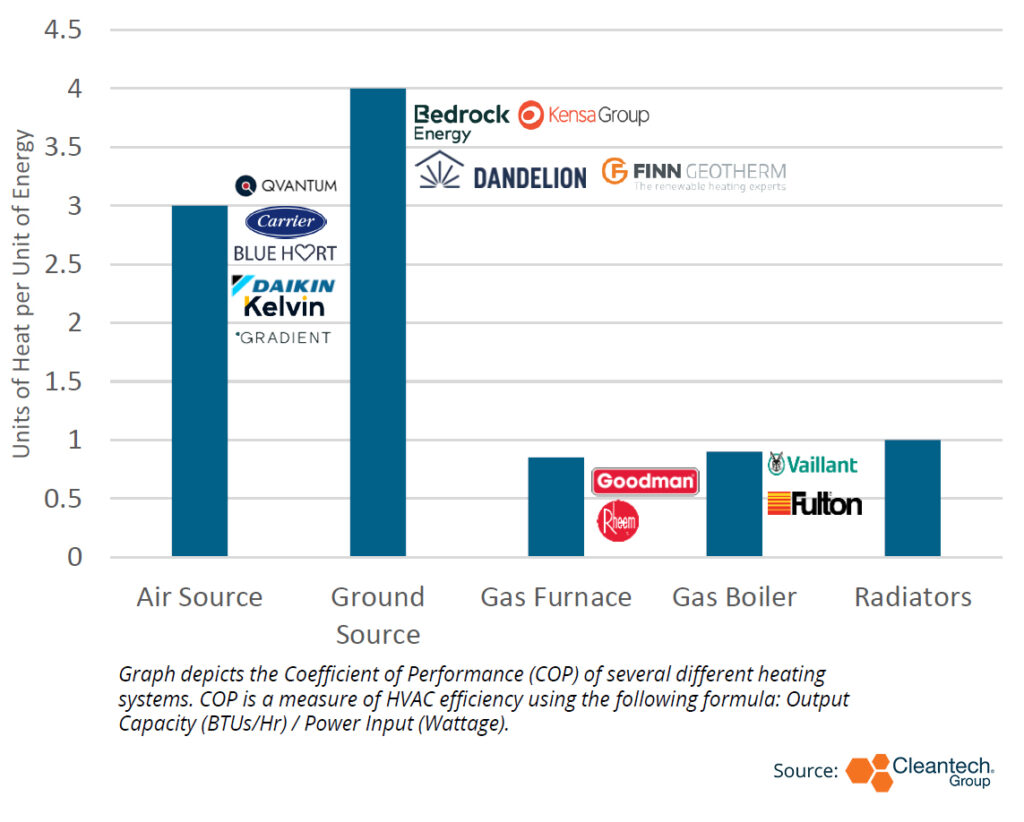

The two primary technologies in heat pumps used to heat/cool are air source and ground source. Air source moves heat from ambient air inside or outside the home, while ground source moves heat from the earth through a series of boreholes and refrigerants/water. Both types have specific strengths and areas for innovation to improve efficiency:

- Air Source: Currently concentrated in urban apartments or small homes, these heat pumps are already 3x more efficient than gas boilers or furnaces on average but require substantial innovation across technical components to address cold weather performance and heating output including improved refrigerant performance/safety, improved expansion valves, and incorporation of atomizers. Compressors are the hotbed of innovation at the moment with innovators positing thermoelectric semiconductors and perovskites as potential replacements.

- Ground Source: Traditionally a commercial heating tool, new builds and district heating networks are turning to ground source due to its reliability and low operating cost. The key issue with ground source is the system’s installation cost. Innovations to reduce both drilling cost (drill-hammers, plasma arc priming systems) and land requirements (e.g., Celsius Energy’s boreholes along a home’s foundation) provide pathways to improve ground source’s feasibility.

While ground source is both more efficient and cheaper to operate compared to air source, 90% of installations in Europe have been using air source. Similarly, manufacturers are expanding production exponentially while installations increase gradually. The installation market for heat pumps has been remarkably slow in its uptake of new technologies, slowing adoption of already complicated ground source installations as well as air source heat pumps generally. Approaches to address this delay include digital consultation or marketplace software that expedite installation and communication (e.g., Lun, Genius Energy Lab, Woltair) and attempts at vertical integration (e.g., Kensa).

Heat Pump Innovator Spotlight

- Gradient: Gradient is a producer of window unit air source heat pumps without additional installation cost. Gradient has improved air source performance in cold climates by incorporating atomizers and next-gen refrigerants. The company has been especially successful in attracting public investment for their work in decarbonizing New York City heating and cooling.

- Kensa: Kensa is a heat pump manufacturer, installation designer, and utility owner focused on ground source heat pumps. Kensa is targeting widespread rollout of district heating systems in Britain by 2025 in which the company incurs all capital cost but receives relevant tax credits and owns the subsurface infrastructure.

- Woltair: Woltair began as a software company connecting installers, planners, and manufacturers in the heat pump marketplace. Their software services increase installation productivity threefold, and the company recently began producing its own heat pump.

Coefficient of Performance (COP)

Residential Heat Pump Trends and Long-Term Outlook

For a home requiring both heating and cooling, the economics are clear that heat pumps are more efficient than a combination of a boiler/furnace and cooling system. However, air source struggles to heat large homes, ground source installation is expensive, and value chain disconnects relegate heat pumps to limited market niches.

Solutions to these issues are varied. For air source, large corporates like Carrier and NIBE are recentering their portfolios with big bets on expanding manufacturing through acquisitions and European expansion. Oil and gas technologies have become a norm in ground source, with companies like Bedrock Energy rapidly converting borrowed drilling and software technologies for heating. Industry cooperation remains limited, though, but shows promise with companies like Genius Energy Lab and Kensa creating robust shared intellectual properties (IP), while Aira and MTEK work together on factory optimization.

Policy varies exceptionally by country and region. In Asia, Japan is dominating IP filing for new technologies while China fortifies its position as the largest volume manufacturer of heat pumps. In Europe, legislation banning boilers/furnace installations is spiking heat pump demand while subsidies for neighborhood district heating systems create pathways for ground source in urban areas.

The U.S. leads the way in supporting start-ups with the Department of Energy awarding dozens of innovators grants to expand their production or research technologies. As the number of people requiring heating and cooling grows, replicating successful policies in Asia, Latin America, and Africa will be essential to curb reliance on fossil heating.

Residential heat pumps have been a promising technology in reducing emissions for several years. Now cast into the mainstream by the Russia-Ukraine conflict, innovators have a golden chance to perfect heat pumps and introduce the next generation of HVAC solutions.