Robotics, Automation and Industry: Why Robots are Now a Good Thing

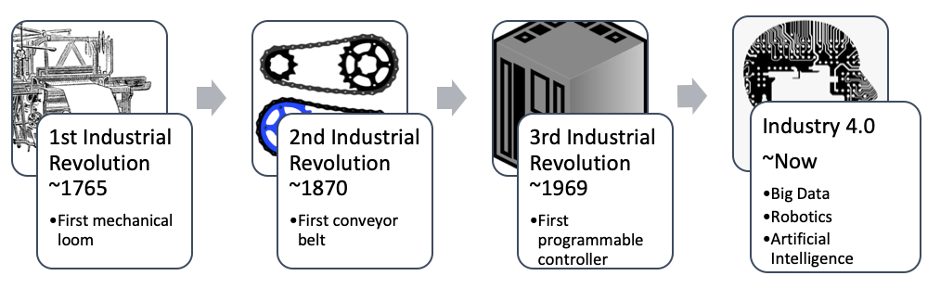

Since 1765, various industrial revolutions have dramatically changed the landscape of manufacturing, enabling scaled-up production that requires less and less manpower. Today, a combination of real-time data analytics, automation, artificial intelligence, machine learning and interconnectivity is driving Industry 4.0, ushering in a new era of manufacturing and production. Major global industries- including chemicals (estimated at $ 3,938 billion in 2019), Fast Moving Consumer Goods (valued at $10,020 billion in 2017) and automotive manufacturing (valued at $1,680 billion in 2018)- can all benefit from process optimization to further increase efficiency and reduce costs related to energy and resources. By streamlining their operations, they can also cut their environmental footprint.

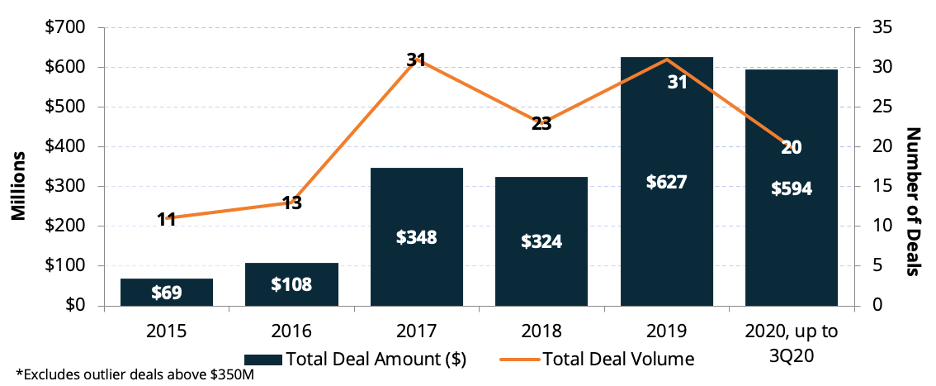

In 2019, the industrial automation market was already valued at $168 billion, with a CAGR of 8.9%. Investment in start-ups developing innovative process optimization solutions in the cleantech space is on the rise (see Figure 2).

Start-ups Advancing Innovation

Innovators are deploying a number of different solutions to optimize industrial processes, including:

MakinaRocks, the equity-funded innovator, partners with major conglomerates such as Hyundai to predict and detect anomalies in manufacturing processes, thus improving control. Beyond Limits has gained considerable momentum, recently raising $133 million in growth equity funding from BP Ventures and Group 42. Taking a cognitive approach to AI-cloud computing, Beyond Limits provides operational insight and automates human decision processes across a number of industries including the oil, gas and utility sectors.

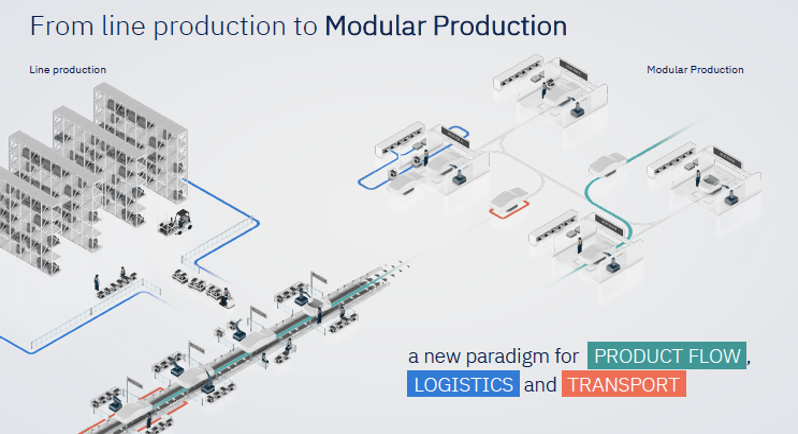

Start-ups are also developing turnkey solutions, combining hardware and software to optimize production lines and processes. Arculus is using AI-powered, autonomous, mobile robots coupled with a process optimization software to develop modular and flexible assembly sections. By deviating from one-dimensional assembly lines, there is both a reduction of required space and an increase in productivity (due to reduced lead times). In addition to this, the company also offers automated goods-to-person software solutions for warehouse applications as well as intelligent traffic management platforms for fleets (which can be integrated with third-party robots). It has recently raised $17 million in Series A funding from Atomico, Visionaries Club and La Famiglia. Current customers include Porsche, Siemens and Audi.

Start-ups are making use of the industrial internet of things (IoT) to collect and analyze operational data to optimize process variables. Samsara has developed IoT hardware and software solutions for large scale, wireless sensor systems for real-time asset monitoring. Process variables and the condition of assets can be remotely monitored on a production line, thus enabling predictive maintenance. Samsara raised $400 million in growth equity funding in May 2020. Another innovator, IndustrialML, has developed an analytics platform based on machine-learning to make factories smarter. It monitors processes by using line and machine-based sensors, combined with ML-based real-time analytics, which predict and alert to incidents. IndustrialML is a 2020 MassChallenge finalist and is part of Plug and Play’s Internet of Things Batch 13.

Although these innovators all propose different technology-based solutions catering to different markets, to stand-out and really compete, start-ups need to determine the right use for their technology and offer a well-rounded business solution. It is also crucial to focus on short-term goals and not overextend resources to succeed. In fact, the start-ups included in this Insight are making use of data centers and platform hosting capabilities built by industry giants ; in other words, the start-ups are not venturing into multiple verticals at a time.

Push from the Industry

Governments, corporates and other organizations are joining innovators to accelerate the adoption of Industry 4.0 solutions.

Governments are realizing the importance of transforming existing industries to boost economic growth. As such, they are promoting transformative technologies through research grants and financial incentives (for companies). The United States government has set up several funds dedicated to smart and advanced manufacturing, including the $10 million Smart Manufacturing Innovation Institute Awards and the $67 million Office of Energy Efficiency and Renewable Energy’s fund. Governments are also setting up the necessary framework , taskforces and organizations to oversee the adoption of new technologies. Germany’s Plattform Industrie 4.0 was set up to develop technical framework, while NIST, a U.S organization, supports the integration of robotics in industrial settings.

Corporates, meanwhile, are providing building blocks by supporting technology for Industry 4.0. For example, Microsoft has established itself as the hosting partner for Industry 4.0 solutions through its hybrid cloud and deep domain capabilities while ABB is leading the manufacturing of collaborative robots that can be integrated with third party software. Through collaboration, corporates are advancing this new industrial revolution using their different strengths and technologies. Microsoft and Hitachi are developing next-generation digital solutions for manufacturing and logistics using Hitachi’s IoT solutions and Microsoft’s Azure cloud platform. Partnering with Accenture, Schneider Electric has also established a Digital Services Factory to accelerate the development of digital solutions that enable Industry 4.0. Volkswagen is developing an “industrial cloud” in partnership with Amazon Web Services and Siemens that will act as a testing bed for third-party optimization solutions.

Corporates have access to deeper domain knowledge and infrastructure and are now using this to develop overarching solutions for Industry 4.0 that can be supplemented with third-party solutions as well. Siemens, for example, allows for ‘add-ons’ on its MindSphere operating system where innovators can develop and upload applications to its cloud store and utilize its hosting services. Through acquisitions, corporates are integrating innovative solutions with their platforms and strengthen their offering.

Technical Barriers

Whilst productivity and efficiency of industrial processes are improved with automation and big data analytics, it does come with its own technical challenges. Both physical and digital systems need protection from cyber threats so a framework is put in place that includes proactive monitoring and contingency plans. Disruptions to the process can be common as well if data traffic is high or correct access controls are not in place.

Not only do today’s industries need to be productive and efficient, they must also be resilient. 2020, in particular, has made the case for remotely controlled, automated industrial processes, where operations are not reliant on workforces being present on site. This is an area that depends on immensely robust and secure networks and cognitive AI.

Keep an Eye on…

- Deep neural networks: a complementary technology that can enhance AI processing capabilities and power efficiency. Deeplite is developing AI-driven neural networks with applications in edge devices including sensors, cameras and vehicles.

- Advanced Augmented Reality (AR): Coupled with wearable technology and advanced human-machine interfaces, industries can go through massive transformation in maintenance and quality assurance by utilizing AR. Augmate is developing AR wearable products and is in partnership with Toyota, UPS and L’Oréal among others.