Smart Waste Collection

The world generates 2.1 billion tons of municipal solid waste annually, and this amount is expected to increase by 70% in the next 30 years as the world’s population and urbanization grow exponentially. The status quo of waste collection includes trucks with predetermined routes that are proving to be inefficient in dealing with increasing waste generation.

Most waste is not sorted correctly at disposal, leading to sub-optimum recycling rates whereby roughly 75% of the waste stream in the U.S. is recyclable, but only 30% of it actually gets recycled.

Approximately 80% of waste collection happens at the wrong time. Early waste collection causes higher costs, more traffic and unnecessary carbon emissions, while late waste collection leads to unsanitary conditions, streetside dumping, and higher costs.

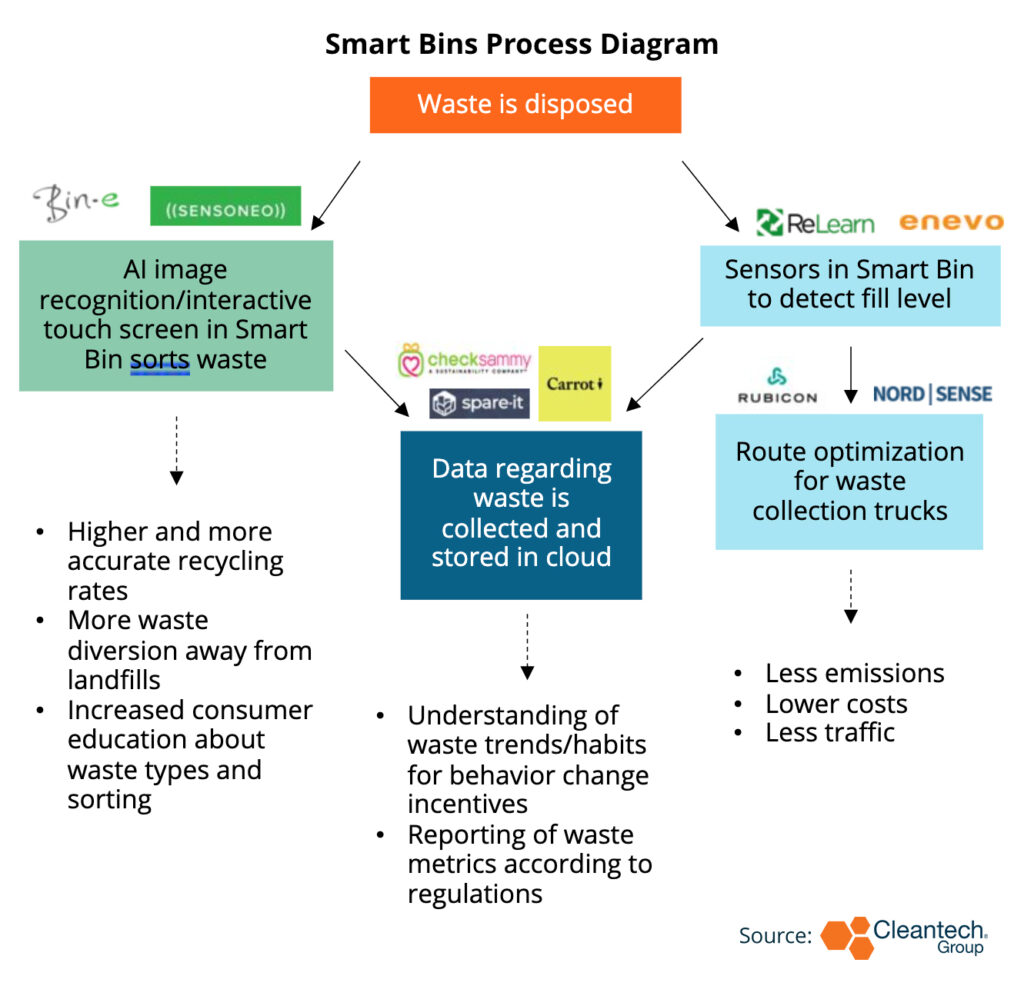

Some key types of smart waste collection technologies and their impacts include:

- Sensors: Connected IoT sensors placed within bins identify fill levels, orientation, and temperature in real time, enabling the mapping of optimal routes for waste collection trucks e.g., Nordsense and ReLearn

- Image recognition: Bins with cameras use computer vision and AI to identify waste types and recyclability to facilitate sorting at the collection point. This reduces human sorting errors and the amount of waste that ends up in landfills, e.g., Sensoneo and Spare-it

- Data Analytics: Smart bin data provides metrics for businesses and individuals to analyze their waste habits and create targeted waste reduction changes, e.g, Carrot and CheckSammy

In addition to waste generation increasing at alarming rates, there are several key drivers that are encouraging smart waste innovation:

- New government regulations, such as Extended Producer Responsibility (EPR), are likely the most pressing drivers. They put the onus on waste producers to prove that their waste is being diverted from landfills, encouraging corporates to invest in waste management technologies.

- Increasing costs for waste management warrant optimization technologies. Smart waste collection can reduce waste collection costs for municipalities and businesses by up to 30% and reduce carbon emissions by up to 60%, according to Sensoneo’s statistics.

- The development of smart city initiatives, especially in North America and some in Asia, are increasingly incorporating smart waste systems through public-private partnerships. For example, Rubicon developed RUBICONSmartCity for government fleets and recently began a multi-year contract with the City of Miami’s Waste Management department to optimize their waste management processes and provide data analytics services.

While there are several incentives for innovators, it is crucial to understand what drives success in this space. From our research, we identified key opportunities and characteristics. Two of these include:

- Channel partnerships with companies who have large and complex waste chains-of-custody such as hotels, retail, and airlines. Some recent partnerships are Carrot with ISS Norway, and Spare-it with Nespresso and Grand Hyatt.

- Ability to cater software technology to each business and geography – while optimizing plug-and-play and productization of hardware elements for scalability.

Finally, looking at competitive trends, incumbents such as Veolia, Waste Connections, and Waste Management Inc., have been innovating in-house. For example, Waste Management has been piloting smart trucks. Incumbents are also working with innovators, e.g., Waste Connections and AMP Robotics have developed a technological partnership to use AI-guided recycling robots.

Looking ahead, we can expect the incorporation of smart waste companies and the number of innovators in the space to only increase. New innovators would benefit from forming early partnerships with new untapped clientele such as real estate and property management companies in North America. In Europe, we can expect a growth in government grant opportunities and accelerator programs to encourage more innovators to join the field and encourage competition and partnerships.

In Asia, as mobile and internet access increases at an unprecedented pace, we can expect a rise in municipalities endorsing software that connects and formalizes existing informal waste picker networks. Africa and Latin America are largely untapped markets and emerging innovators would benefit from introducing software to formalize existing informal waste management with pickers and recyclers.