What’s in Store for ’24? Hopes, Expectations and Things to Pay Attention to

I expect a curate’s egg kind of year for global cleantech innovation in 2024.

Cleantech Group sees plenty of areas to be excited by, but after the over-exuberant and low interest rate markets of 2021, we believe the re-adjustment process in the global cleantech venture portfolio has another year to run.

Especially when you consider this period of “climate stuckness” we are in, and the uncertainty and instability in the macro environment, not least with regards to how all the many 2024 elections play out.

In the second half of this thought-piece, we list a few expectations and hopes for 2024. For such, to have meaning, it first requires an appreciation of the broader context.

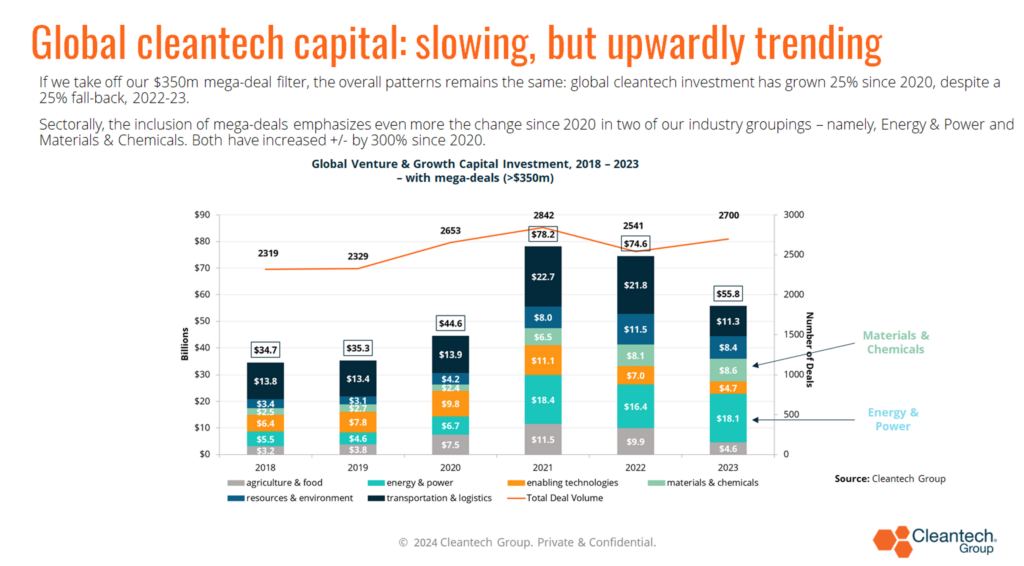

Global cleantech venture and growth capital investments were 25% down on their 2022 levels, but as I argued in my keynote at our recent 22nd annual Cleantech Forum North America, such a blunt aggregated figure really tells you very little. Be it up, down, or flat.

That is because cleantech is a cross-cutting innovation theme, involving so many geographies, all the sciences, all TRLs and company development stages (from pre-seed to mega-rounds for unicorns), and companies we categorize into >1400 sectors and sub-sectors (as per our proprietary taxonomy), providing (potential) solutions to almost every part of the global industrialized economy you can imagine. Homogeneous it is not.

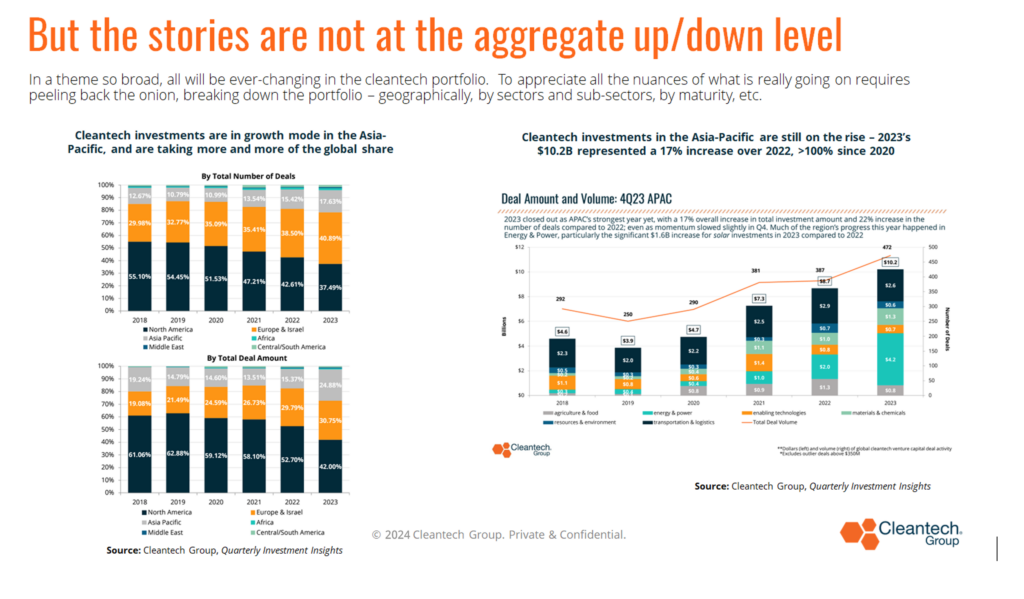

Cleantech innovation investment in the Asia-Pacific, for example, continued its upward journey in 2023, and speaks to the ongoing globalization of innovation – nowhere more so than in our space, where solutions and good companies are coming from everywhere.

Unlike in most innovation themes, the US today accounts for less than 50% of the global deal count in cleantech and that % has been consistently trending downwards for the last few years.

At a global level, there is also a different 25% number to keep in mind – 2023 was 25% up on 2020, and we think for any serious analyst of this multi-decade innovation journey, this is the more important 25% number to be focused on, at this point.

It indicates the sense of a continuing upwardly trending journey from the Paris Accord onwards for our theme, writ large. We regard the spikes of 2021 and 2022 as the anomaly period, caused by very hot spaces in Agriculture & Food and Transport & Logistics, as illustrated below.

More specifically, those two industrial areas have fallen back in 2023 by more than 50% because of massive pullbacks in very particular investment sectors, ones that had arguably become over-invested and over-heated – namely:

- Alternative Proteins and Indoor Farming in our Agriculture & Food industrial grouping:

- Alternative Proteins’ $577M total for North America in 2023 was nearly 7x less than its $3.5B total in 2021. The global fall was closer to 5x ($1.2B in 2023 vs >$5.5B in 2021)

- Indoor Farming’s $153M total for North America in 2023 was nearly 10x less than its $1.45B total in 2022. The global fall was closer to 6x over the same period.

- On-road vehicles and supply chains and logistics in our Transport & Logistics industrial grouping:

- Supply chains and logistics’ global $680M total in 2023 sits in stark contrast to the >$20B (yes, $20B) that had been invested in the 9 quarters since 4Q 2020.

- At a global level, on-road vehicles (think EVs and mainly passenger EVs) pull-back is less dramatic. Its $7.3B global total for 2023 is more a case of trending downwards, by 14% from 2022’s $8.5B, that after a fall of 16% from 2021’s $10.2B. Again, aggregated data masks a complete investment shift, geographically.

- In 2021, North America accounted for more than 50% of such investments

- In 2023, the Asia-Pacific, led by China and backed up by India, accounted for nearly 70% of such.

These examples speak to two key assertions, namely that:

- 2021 and 2022 investment levels were extra-ordinary, especially in how dramatic the investment levels were into supply chain and logistics in the Covid period when their fragility and inefficiencies were so brutally exposed.

- Across the whole cleantech portfolio, there will forever be sub-sectors in growth, some in fall-back mode, some over-valued and re-adjusting, others emerging from earlier stages. Get used to it, people; it has always been thus.

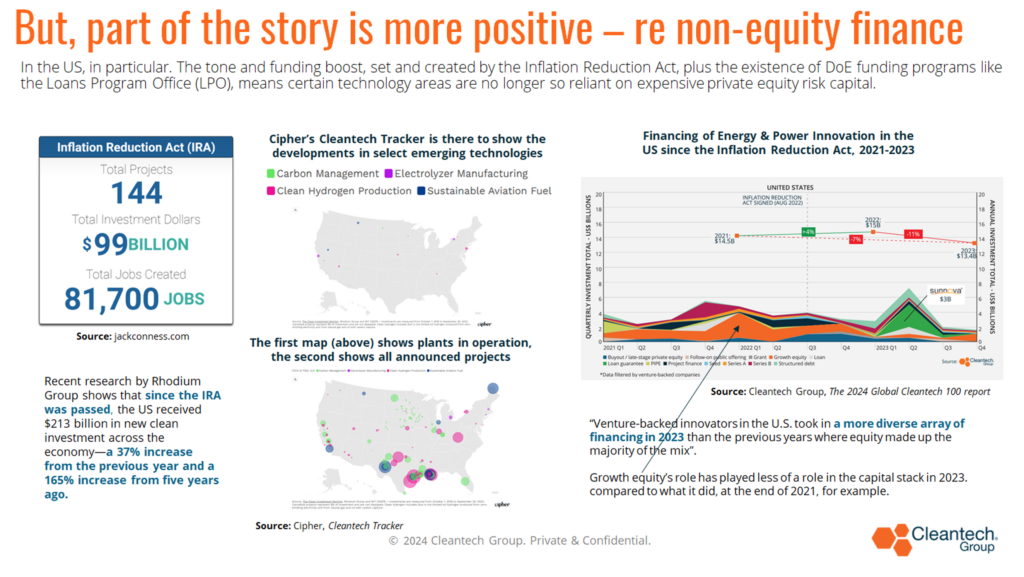

Nowhere is this truer than in the US, the largest single venture market in the world.

Its 45% fall 2022-23 is the most dramatic re-adjustment/pull-back in the global dataset, reflecting the end of easy money, less receptive exit markets, especially in IPOs, and reflecting the pronounced up/down cycles which have always characterized US Venture Capital.

That might feel all quite gloomy as we head into 2024, but actually there are three big “but’s” to keep in mind:

- The early stage continues to be strong, particularly in some of the hardest to abate sectors. Encouragingly, through this period, “deeptech” cleantech – think areas like batteries, cement, fusion, and steel – have accounted for 13% of all investments across 2022 and 2023 (vs. 6% across 2018-2020). A new investment wave focused on deeper decarbonization solutions for the 2030+ period has established itself.

- There is still plenty of dry powder, and even though fundraising is harder than two years back, say, new funds are still getting raised by the most credible fund managers.

- 2023 has seen a healthy emergence in the US of non-equity finance in the later-stage capital stack, stimulated by the Inflation Reduction Act, alongside the Bipartisan Infrastructure Law. We should celebrate the fact that expensive growth equity has been able to play less of a role in the financing of future manufacturing plants and in this new period, we are seeing more and more projects in key decarbonization sectors be announced and go into construction.

Against all that background, here are out some of our hopes and expectations for 2024….

Expect Energy & Power investments to remain resilient.

Investments into Energy & Power cleantech companies globally have increased nearly 300% since 2020, stimulated by energy insecurity and geopolitics, enabled by renewables, led by solar, offering such competitive pricing, and in the context that we need to meet the goal of trebling renewable capacity by 2030, as part of the drive towards agreed climate goals. The race is on.

Especially in areas that relate to the challenges of speed, scale and optimizing efficiencies.

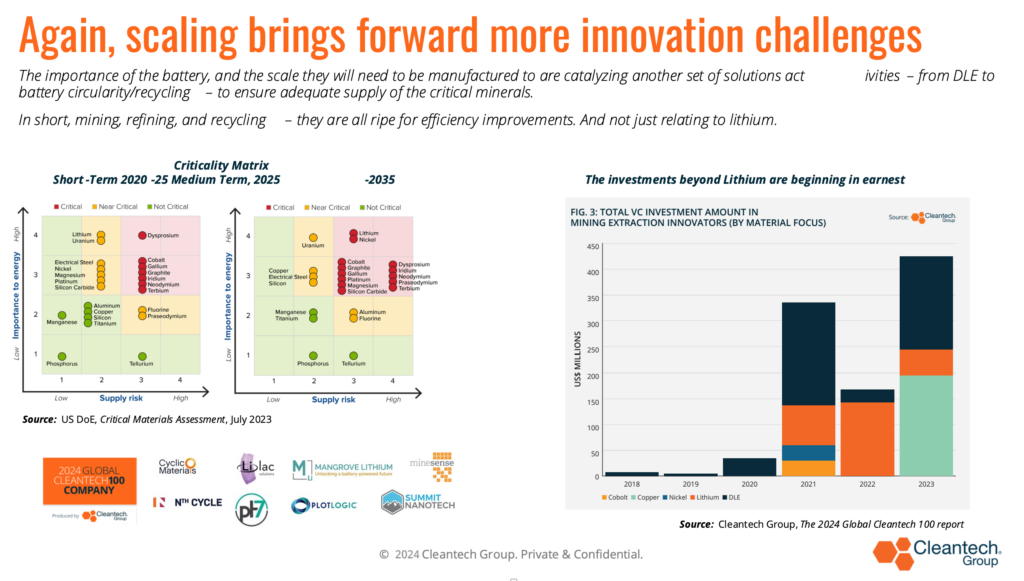

The push for scale begets a whole series of other innovation challenges/opportunities – not least in energy storage and materials.

With batteries, every aspect to improve efficiencies and achieve cost-downs are being pursued – from innovations relating to the anode to the cathode, from alternative chemistry options (enabled by graphene, for example) to recycling (to shore up access to the critical minerals).

Expect the push for resilience in the supply of critical minerals to continue (beyond lithium).

There have been major investments in securing lithium’s availability – be that via direct lithium extraction or recycling – for the last 2-3 years. We expect to see this general trend continue but with more focus on other elements, too – be that copper, cobalt, nickel, zinc. The list (concerningly) goes on and on.

Expect the materials revolution to continue in 2024.

Decarbonization at meaningful scale cannot happen with such minerals in adequate supply but nor can they happen without new materials being developed ever faster, cheaper.

Example areas might include sorbent innovation to help reduce costs of Direct Air Capture, or new catalysts to produce e-fuels for aviation and shipping; or materials to store heat at high temperatures (1300°-2000°C), thereby unlocking industrial process heat markets.

Like Energy & Power this industrial category in our taxonomy has seen global investments increase by approximately 300% since 2020. We expect to see materials innovation investments in 2024 remain strong.

In the spirit of faster and cheaper, we expect AI in Cleantech to be looked at harder and harder in 2024.

Nothing new at one level, but we are busy identifying businesses whose whole value propositions are built on AI’s unique capabilities (vs just a tool to create incremental improvements). One area of high potential is the ability to turbo-charge, via higher computing power, the development of new materials, new ingredients, etc. Over the last 2-3 years, the heaviest investment area for AI in cleantech has been around precision harvesting, weather prediction, crop and soil monitoring, farm management and smart irrigation. Recycling and battery intelligence are areas on the rise too.

Expect some blood on the streets in 2024.

Keeping it real, we know bridge loans and insider rounds have been common of late, in the hope of riding out a tough fundraising environment and to avoid down-rounds. Not everything is postpone-able and we expect to see some tough choices having to be made in 2024, leading to a rise in consolidations, secondaries, and bankruptcies (in sub-sectors where there may be too many “me-too’s”).

One such area might be in the carbon management support services arena. Not the carbon removal companies, themselves, but more in the monitoring and verification technology and marketplace companies. So many have been invested into, 2020-2023, but we are in a period where the carbon offsets markets are not working well enough and doubts on the quality of data and quality for resultant offsets persist and are creating headwinds.

In terms of hopes, more than outright expectations, I will call out three to end with.

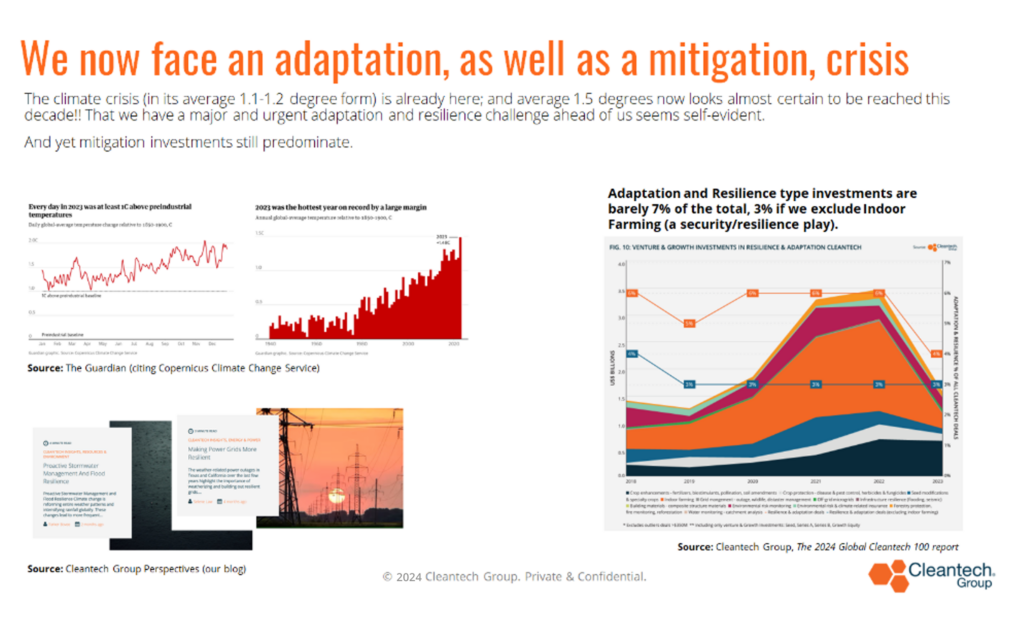

We hope to see the first pureplay adaptation-focused fund, as a signal of acknowledgement of the sobering reality that we are simply not going to limit the planetary temperature rise to anything close to 1.5°C.

We are heading to a world where droughts, floods, heatwaves, wildfires, and other climate-driven disasters will become normal parts of most years – for the rest of our lives. To function industrially, to function as societies, we have to invest in adaptation, as well as mitigation. This will present some interesting, and near-term, innovation-led opportunities.

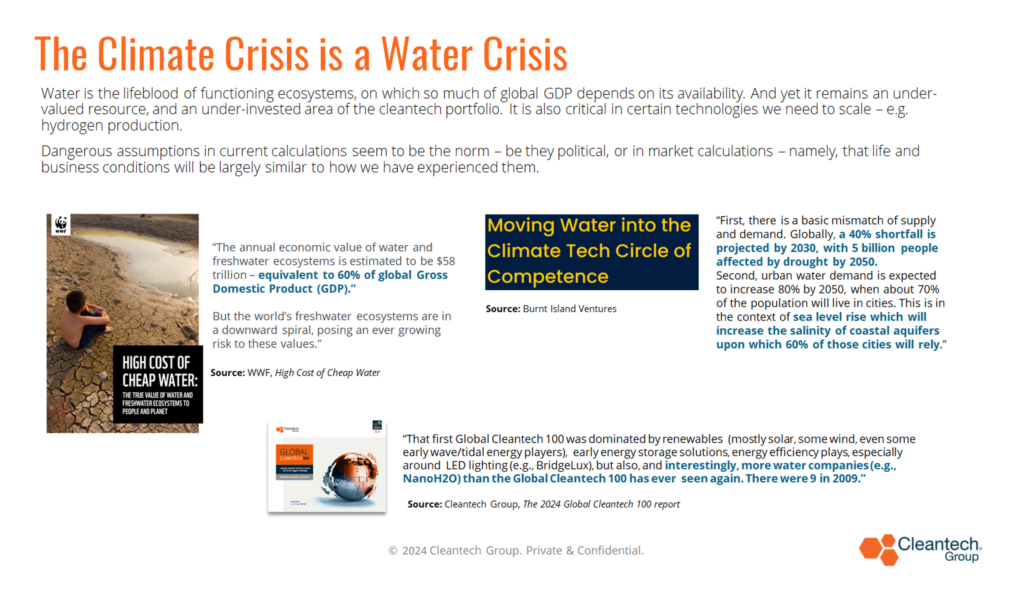

We hope to see a growing interest in water-related investments in 2024 – perhaps starting at the intersect of energy and water.

Given how long water investments have been a laggard, we don’t expect significant change in 2024 but perhaps at least there might be some shift in appreciation of how the first crisis we are likely to face in the coming years, is less an energy supply crisis but one of water, the lifeblood of nature, industry, and society.

And finally, we hope (even pray) for climate-progressive policies to remain at best, largely unimpacted.

Watch out for the elephant in the 2024 room – how does climate policy and momentum get impacted by elections’ outcomes?

Yes, venture/growth investments are in a re-adjustment phase, as we enter 2024. But arguably, the innovation ecosystem has never been stronger, and it is playing its part.

But to climb the ever-steepening mountain, we need all other stakeholders to play their part – policy, big finance, corporate leaders – to innovate, to act faster, to live up to their words and pledges, to stimulate the demand, to develop new-look financing instruments, fit for purpose for the challenges ahead.

Will 2024, dubbed by The Economist as “the greatest election year in history”, with more than four billion people heading to the polls, deliver us idealogues and populists, or pragmatists ready to argue that solving climate change is not only necessary but is the route to greater national security and economic prosperity, if we can stay the course?

The three elections to watch, for their impact on the direction of global cleantech for 2025+, are India, the EU and the US – India, because of its growing influence and sheer size; the EU, because Europe has been the steady hand setting a consistent tone in global dialogues for three decades, and giving us regulations that tax carbon, ban toxic products, etc; and the US, because having just got itself heading towards a more decarbonized and industrial future, built on technology, and domestic manufacturing and jobs, full-force Trumpism could hit the reverse course button.

Will we end 2024 still looking like a world sincerely transitioning away from fossil fuels, or will we have taken a lurch backwards and be left to the whims and vagaries of a few authoritarians?

Richard Youngman, CEO of Cleantech Group, shares his insights and predictions for 2024.