Alternative Proteins and New Business Models – The Changing Face of Food

Traditional protein farming will be turned on its head this decade as new products and production techniques disrupt the industry. Barclays estimates the alternative meat market will grow from 1% of the global market share in 2019 to 10% in 2029 with $140 billion in market share. AT Kearney predicts that by 2040, up to 60% of the meat industry could consist of meat products made from alternative proteins, with cultivated meat comprising 35% and plant-based meat reaching 25%.

In Asia, the plant-based meat substitute market is predicted to be worth $15.8 billion in 2020. Meat and seafood consumption will rise 78% by 2050 in the region. Research from the FAO indicates the demand for poultry alone will undergo a whopping 725% growth from 2000 to 2030 across Southeast Asia. China’s plant-based meat market is already worth $9.7 billion and will grow to $11.9 billion by 2023. China’s importance, not only as a consumer but as a critical part of the plant-based protein supply chain, should not be underestimated. 70% of global soy protein isolate, a key plant-based protein ingredient, is processed in the Shandong Province of China.

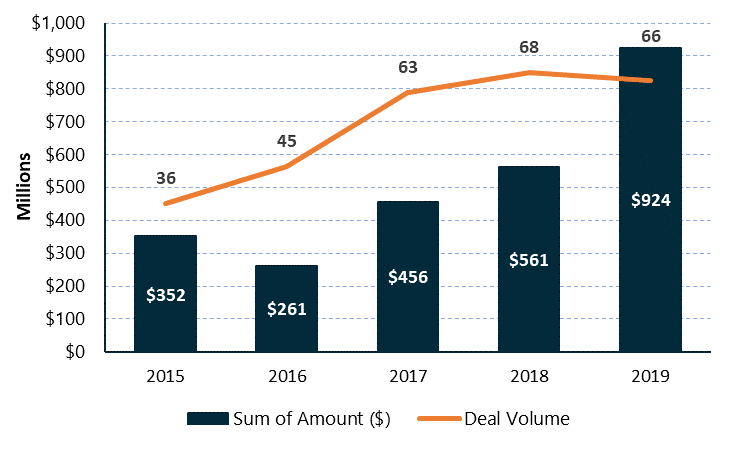

Figure 1: Venture investment in protein-based innovation[/caption]

Figure 1: Venture investment in protein-based innovation[/caption]

Consumer demand is driven, in large part, by environmental and animal welfare concerns. 98% of the livestock industry’s water usage, and 33% of all cropland, is used to grow feed to raise animals, while 26% of the world’s ice-free land is used to graze livestock. Regarding animal welfare, 75% of the global supply of antibiotics is fed to livestock. Despite this heavy usage, the recent African Swine Flu epidemic is predicted to kill a quarter of the global pig population.

Business Models

In the plant-based space there are two sales models being tested at scale. A product is either sold through retail outlets (Beyond Meat) or offered on menus through restaurant and fast-food operations (Impossible Foods). The second option works at a higher price point, with Impossible Foods’ product selling at Burger King for $1 more than conventional counterpart. Beyond Meat is sold as a premium protein product at the grocery store and is increasingly appearing in restaurants.

In the cultivated meat space, it is likely the first commercial products will be sold through to restaurants. The initial cultivated meats to hit the market will be ingredients rather than centre-of-the-plate products, due to the difficulty of growing proteins into recognizable and conventional meat structures. Cultivated meat does not depend on any particular crop and so production facilities can be distributed and localized. This is leading many innovators to consider 3D printing and small-scale growing facilities. The first commercial facility to fill this space is Memphis Meat’s $161 million plant in California, which is currently under construction; its exact size and production volume is undisclosed.

Dairy alternatives will grow over the next five years as casein and whey proteins (the key proteins in cow milk) reach production cost parity with traditional milk. 35% of all dairy is consumed indirectly through food products and this will be the first target for protein alternatives. Replacing animal milks with alternatives is already happening with companies such as Califia Farms raising $225 million to accelerate the building of production capacity to meet growing demand.

Competition

Given predictions, such as RethinkX’s recent report which estimates 50% of revenues in the US beef and dairy industry will disappear by 2030, industry incumbents are trying several methods to stay competitive in the meat and dairy market.

Cargill recently announced it plans to introduce plant-based patty and ground products. The announcement follows a joint venture formed with Puris in 2018 to provide pea proteins. The company has also invested in cultivated meat companies including Aleph Farms and the Memphis Meats.

Tyson Foods have placed a number of bets on new protein manufacturing techniques, including Memphis Meat, Future Meat Technologies, MycoTechnology and, most famously, Beyond Meat. In 2019, the company also released a hybrid plant and animal-based product which was half pea and half Angus beef protein, which was tialed at Brewdog restaurants in the UK. In that same year, Purdue Farms released a similar product, a half chicken and half plant-based protein.

While Cargill and Tyson are introducing consumer-facing products, they are also developing the next wave of ingredients and raw materials to supply alternative protein products. Similarly, Nutreco’s recent partnership with Mosa Meat will aim to develop a growth medium for cultivated meat producers which can enable cost-competitive production.

Competition between plant-based products is low but growing quickly, as the scale of market demand is far larger than the currently restricted supply. For cultivated meat companies, competition for capital investment is higher as there are several companies trying to make the jump from Series A to Series B to prove out production methods and hit cost reduction targets. Memphis Meat’s $161 million Series B was the first, and we expect to see a number of similar fundraisings in 2020.

Keep an Eye on…Seafood

Seafood consumption is projected to rise 21% by 2025. Consumption in Asia will be responsible for 73% of this increase, consuming over two-thirds of the available seafood supply in the world. Innovators such as Shiok Meats, a Singapore-based developer of cultivated shrimp products, will look to capitalize on this growing market. The company is working to reduce the cost of production for a cultivated shrimp product from $5,000/kg in 2019 to a market competitive $50/kg in 2021.